What are the Top ASX Lithium stocks to Buy?

2 Quality lithium companies with a big future

Stock market confidence in the demand outlook for battery grade lithium carbonate has increased. Our analysts agree investor demand for exposure will continue rising. These companies are all in production and have growth potential. Please remember: Stock advice changes all the time! Before you buy shares, get today's buy, sell and hold advice and up to date stock data. Free Access or 14 days.

We said Buy 32 cents

Pilbara Minerals (ASX: PLS)

Share price: $4.83

Tip price: 32c

Market capitalisation: $14bn

Dividend: 5.2%

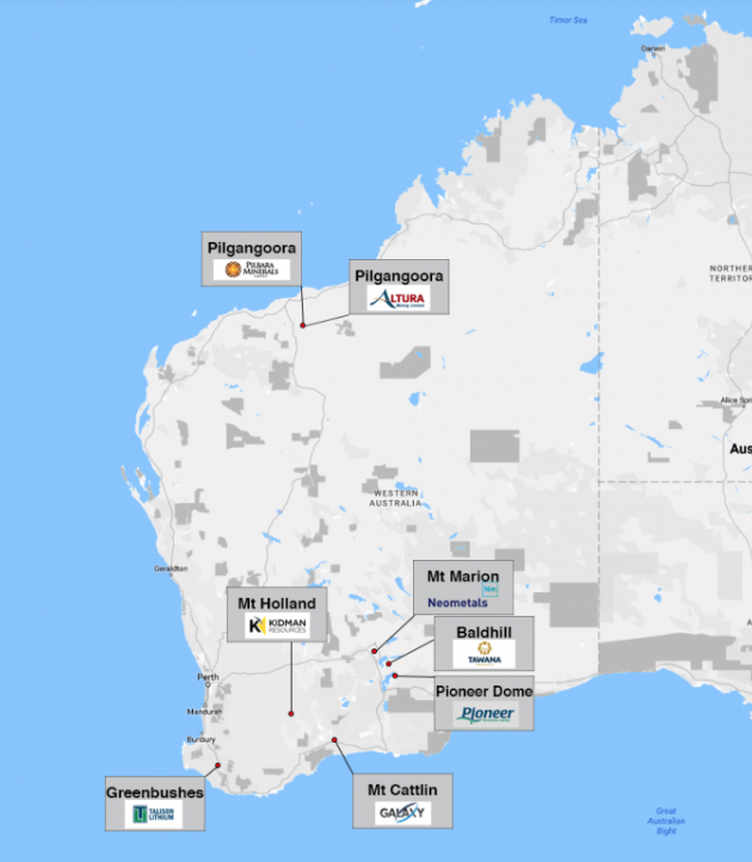

Pilbara Minerals is an Australian based lithium-tantalum producer. It owns 100% of the Pilgangoora hard rock lithium project, located 120km south of Port Hedland, Western Australia.

The company is also aiming to build a presence in the downstream value-added lithium market through the development of chemical conversion plants in South Korea and China.

We said Buy at $2.42: 5 Dec 2019

Allkem (ASX:AKE)

Share price: $15.40

Market capitalisation: $9.6bn

Dividend yield: 0%

Net cash: $850m

Orocobre took over Galaxy Resources, in a bid to centralise Western Australian Lithium production reducing overhead costs in processing, forming Allkem. This is now one of the largest companies in the sector.

ASX: AKE is exceptionally well placed as an existing producer with a significant planned and funded expansion project. There is still a surplus in the resource but it could be in deficit within two years.

Allkem is a globally significant producer with close to 10% share of the lithium market. It has a defined growth path with a 3-fold increase in production by 2026 with further upside potential from early-stage exploration and development projects.

It has projects in James Bay, Quebec Canada. A lithium project in Argentina and has one of the world's largest evaporation pond systems. It mines Spodumene concentrate in Mr Cattin in WA with a large lithium resource. Plus in Sal de Vida it has a project with superior brine chemistry that readily upgrades to battery grade lithium carbonate.

We have made subscribers over 10x their money on Lithium shares.

Delivering big share price spikes for our subscribers.

We distil over 2,000 companies on the stock market into 100 Small Caps covered by our experts. Then we further narrow your search with our 10-15 Best Stocks to Buy list.

Which Australian companies mine lithium?

Electric Vehicles are driving the demand for lithium ion batteries. We list 7 Lithium Australian companies with big resources and cash flow.

ASX Company

Allkem

ASX: AKE

Is a global lithium chemicals company. It is Headquartered in Buenos Aires, Argentina and its operation includes lithium brine operations and lithium carbonate production in Argentina, a hard-rock lithium operation in Australia and a conversion facility in Japan.

ASX Company

ARGOSY MINERALS

ASX: AGY

Argosy Minerals has a hard rock production in the lithium triangle where the world's largest lithium resources are. 40% of the world's hard rock lithium is mined here at the lowest cost. It also has production is in Nevada US and Argentina.

ASX Company

LAKE RESOURCES

ASX: LKE

ASX Company Lake Resources has the biggest lease lithium project in Argentina. Lake Resources focus is on producing clean resources with a direct extraction technology.

ASX company

LIONTOWN RESOURCES

ASX: LTR

At Kathleen Valley, it's project in Western Australia, Liontown Resources produces 500,000 tonnes of lithium oxide concentrate a year. It also has an active hard rock drilling program at Buldania in WA.

ASX company

PIEDMONT LITHIUM

ASX: PLL

Piedmont Lithium is located in the renowned Tin Spodumene Belt of North Carolina. Piedmont aims to be one of the world’s lowest cost producers of lithium hydroxide. Piedmont is strategically located to serve the fast-growing US electric vehicle supply chain. Its Tennessee definitive feasibility study results demonstrate a robust technical and financial case for Piedmont to establish a merchant lithium hydroxide manufacturing business in the US.

ASX company

PILBARA MINERALS

ASX: PLS

This has been one of our best shares to buy. We first recommended it when it's share price was 32c! Pilbara owns 100% of the world's largest, independent hard-rock lithium project. It will produce over 1 million tonnes of spodumene a year from 2025, in a sign the battery metal is not slowing down.

ASX company

VULCAN ENERGY

ASX: VUL

Vulcan Energy aims to produce the world’s first, premium, battery-quality chemicals with zero carbon footprint, by harnessing renewable geothermal energy to drive lithium production, without using evaporation ponds, mining or fossil fuels. It uses deep its geothermal and brine mineral resources in the Upper Rhine Valley of Germany.

What are the best ASX lithium companies to buy?

Power your share market portfolio with ASX listed Lithium projects that are led by small companies and quality management.

Our analysts agree investor demand for market exposure will continue rising. There are a number of lithium stocks on the ASX we have distilled our favourites to 7. Our two favourites have been the two largest producers in Australia. We bought them when their share price was still low.

Pilbara Minerals: We first recommended when it's share price was just 32c and we have made 1,000%+ for our subscribers. That is 10x their money!

Orocobre/Allkem: We have made 6 x our original recommended price!

6 Reasons Why ASX Investors Should Buy Lithium

The Lithium ion battery has become the industry standard for electric vehicles. Companies with existing producing lithium operations will be well placed to benefit.

1

EVs are Unstoppable

We are talking about a 20 year transformation. The move to EVs is unstoppable with all the major car manufacturers factoring EVs into their forward schedules. BMW, for example is expect to have completely exited production of internal combustion vehicles by 2050. This is driving great demand for lithium mining services, exploration and the market.

2

Legislation

The introduction of government requirements for zero emissions applying to all new vehicles has been mandated by certain countries, mainly in Europe, as early as 2030.

3

2025 Forecast Suply Deficit

With demand estimates showing potential exponential market growth to 2025 and beyond, a structural deficit and higher prices could loom by 2025 at the latest. This does not provide much time for new projects.

4

Higher Prices

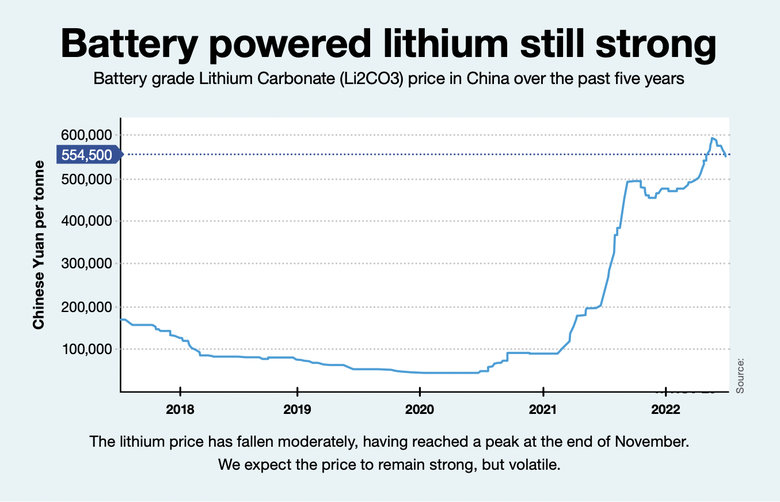

Global weighted prices for lithium carbonate are increasing and the price trend is upward. Lithium hydroxide prices maintain a price premium over lithium carbonate prices. Battery cathode producers are flagging tight availability of hydroxide, because of supply constraints of Australian spodumene.

5

Sustainable Production

Investors will be increasingly cautious of a lithium company which is itself a heavy carbon emitter including for the company, corporate investors like pension funds, financiers such as banks as well as customers. A company's carbon emission reduction strategies are a key consideration.

6

Gigafactory Capacity

In response to the rising EV sales momentum, planned global battery Gigafactory capacity is increasing with a big rise in lithium chemical and conversion capacities in China. This underpins further demand. Battery inputs such as spodumene (lithium concentrate) are converted into lithium hydroxide or lithium oxide.

Who is the biggest lithium producer in Australia?

Allkem (AKE) is the biggest company but Pilbara Minerals (PLS)as a listed company is producing the most lithium.

Amazing results possible at Under the Radar

Inhouse mining expertise

Future facing ethical shares

Investors: Start Now

Before you buy a lithium stock, access our latest recommendation for free now.

Demand outlook

Stock market confidence in the demand outlook for battery grade lithium carbonate has increased as has the share price and market capitalisation of ASX lithium stocks.

Demand outlook

Stock market confidence in the demand outlook for battery grade lithium carbonate has increased as has the share price and market capitalisation of these companies.

Lithium Sector Updates from our Analyst Team

Why you should invest in Lithium

Our analysts explain the battery led revolution and where and why you need to invest in Lithium.

Lithium Stocks To Charge Your Portfolio in 2023

Investing in Australian lithium producers should continue to deliver big rewards in 2023 and beyond.

Lithium market: Rich interviews our mining analyst Peter Chilton

Richard discusses the fundamentals behind lithium prices and why there has been so much corporate activity in this sector with Peter. Lithium production is technically difficult and with Peter's expertise in the mineral resources sector we select the companies with high quality mineral deposits.

October 22: Lithium Market Size, Industry outlook and growth

Find out how rising market demand for EVs and a lack of supply underpins quality lithium stocks.

You need sector specialists when it comes to lithium mining

We were the first to pick Pilbara Minerals when it was 32c. We have made 1,000% for our subscribers. That is 10x their money!

Monster lithium demand growth

Demand for lithium is based on the number of million tonnes of lithium per EVs required and the lithium required per battery. By 2040, battery use will account for almost 90% of global lithium demand.

Over the next 10 to 20 years we will see monster cumulative demand growth as global EV penetration takes hold.

No alternative to lithium batteries

All significant proposals for EVs involve lithium batteries. Lithium is now well entrenched with massive sunk capital in battery and vehicle design and the manufacturing plants to build them.

It seems highly unlikely that any significant commercial substitute for lithium batteries will emerge.

What you need to know about Lithium Stocks

Driven by demand from electric vehicle and battery power, it is now one of the world's most valued and prized mineral commodities. But with confusing terms like Spodumene concentrate, lithium ion batteries, to Lithium Hydroxide and a complex mining process, it is not easy to understand. We give you the basics.

What is it?

It is a chemical element with the symbol Li and atomic number 3. It is a soft, silvery-white alkali metal that can store a lot of electricity.

Battery power

It has the highest charge to weight ratio, allowing the world to carry phones with a light battery, instead of heavy lead batteries. Spodumene concentrate is a high purity grade with about 6 percent lithium. It is a higher concentrate over brine sources but has a higher extraction cost.

Battery Grade deposit

Although it is relatively common, it is rare to find a concentrated lithium deposit. Its even rarer to find a battery grade deposit. As such, a new lithium project anywhere, is a source of excitement for ASX share Investors, especially mines with a long life.

It's light

Cars need an effective power source for their weight, which is why, with lithium’s weight to charge ratio, the Lithium ion battery has become the industry standard for electric vehicles.

How to supply demand?

Production is complex. New demand needs to be filled by new projects, new methods of extraction and conversion, or both.

European Union's Carbon Tax

It aims to reduce emissions by pricing carbon, and forcing companies that produce that carbon to pay for it. Producing Battery grade lithium is an emission intensive process and it is something producers need to watch.

Where is lithium mined?

54% of the world's lithium deposits are in the lithium triangle, a portion of the Andean mountains between Chile, Argentina and Bolivia.

But Australia is the world’s LARGEST PRODUCER of lithium. The majority of lithium resources are located in Western Australia.

Around 60% of million tonnes of lithium carbonate equivalent of the world’s supply, comes from evaporation ponds, are filled with lithium brine pumped from underground. That lithium brine, is then concentrated in them by evaporation, after which it is treated to purge it of other metals, such as sodium and magnesium, and it is precipitated as lithium carbonate. equivalent. It needs to be a high quality to be battery grade.

Going Green

The electric vehicle conundrum

EVs have negligible greenhouse emissions when being used, contrasted with the high emissions from petrol cars and trucks whose mode of power is the internal combustion engine. But manufacture of an EV requires a great deal of energy and produces more emissions than producing a petrol vehicle. Lithium-ion battery manufacturing is energy intensive due to the cost of lithium extraction and its processing into battery grade.

Maximising the life-cycle benefits.

The CBAM and similar schemes around the world create an imperative for miners and others in the supply chain to reduce emissions.

Exporters to the EU pay a levy based on the amount of carbon used in making and shipping products.

It requires information on the carbon footprint of every component from the mine gate to final product supply chain, as part of an “electronic product passport”.

For example, the battery alone could represent in the region of 30% of carbon emissions in an EV's lifecycle.

EU Life Cycle Assessment

Despite being emission intensive, EVs have much lower life-cycle greenhouse gas emissions than petrol vehicles. Government's now want to maximise the life-cycle benefits of EVs.

In order for EVs to make a meaningful contribution in improving the environment over their entire life, there needs to be minimal emissions i.e. in both their production and consumption.

On this front, “Life-Cycle Assessment” is used by the EU and others to monitor and reduce emissions.

How do lithium producers reduce carbon emissions?

Emission reducing strategies are being adopted for lithium mines and production facilities. These include solar power generation, the electrification of vehicle fleets, the use of green hydrogen power and downstream processing to reduce transport related emissions.

Other initiatives that help the environment and reduce costs include water usage and water table considerations.

Experienced Investors: Start Now

If you are an experienced investor and just want to access the best lithium projects from our small cap research, we recommend you get into our dashboard now for 14 days free. We picked Pilbara when its share price was only 32 cents!

1 in 5 of our stocks have been taken over

Delivering big share price spikes for our subscribers.

We distil over 2,000 stocks into 100 Small Caps covered by our experts. Then we further narrow your search with our 10-15 Best Stocks to Buy list.