CommSec Executive Series: Under the Radar Report

Tom Piotrowski from CommSec interviews Richard Hemming.

Want to know what we are most famous for? Our stocks & research..

Accelerate with ASX Small Caps

Is our Small Cap Report for you?

Do you have a strong core portfolio? It's time to add Small Caps! It's time to look past the obvious and expand your future with Small companies.

We have handpicked 100 of the Best ASX Small Cap stocks and are focused on making you money.

What do I get with your Small Cap report?

12-24 New Small Cap stocks a year

10 Best Stocks to Buy Now updated weekly

Fundamental Analysis on 100 ASX Small Cap stocks

Clear Buy, Sell and Hold recommendations

Special Sector Reports

Dividend Portfolios released every 6 months

Small Cap Portfolio

Invest in diverse ASX Small Cap Stocks packed with growth potential.

Video: Stocks of the week from Rich

This week's market update. Have a Friday beer with Rich and find out what's happening in the market and updates on our stocks.

Building Wealth From Scratch In The Stock Market:

Build a thriving share portfolio with our 12 month step-by-step system. Just $99 for the full easy to action program.

Build Up Your Core Portfolio

Income generating Blue Chip Stocks

Is the Blue Chip Report for me?

Do you want to generate income and invest in the big ASX blue chip companies? We have handpicked 40 of the top 200 ASX Stocks across all industries that our analysts agree offer the best value for ASX share investors.

We give you:

40 handpicked ASX Blue Chip Stocks from the top 200

Fundamental Analysis on 40 Blue Chip stocks

Price Targets

Clear Buy, Sell and Hold recommendations

Economic Analysis

PLUS Quarterly Bonus Special reports.

In one quick and easy to read table which makes your buying and selling of shares clear and straight forward.

Add Blue Chips to Building Wealth and have everything you need to Get Started investing TODAY!

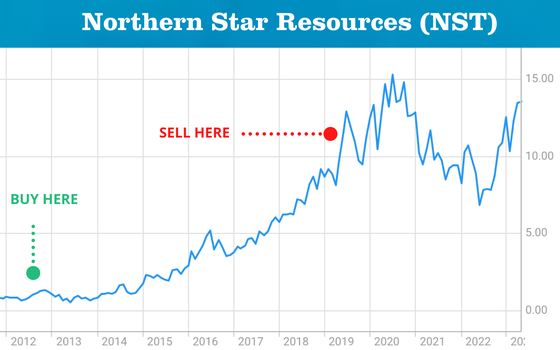

How to Turn $1,000 into....

If you had invested $1,000 when we recommended to buy these shares, how much would your money be worth now?

We hunt for ASX small companies with strong revenue and business earnings.

Our focus is on Small Caps while they are still cheap and in the fast expansion phase.

Australian ASX Share Investors

When it comes to choosing investments, potential return and risk are the most important considerations for many investors. A top challenge is finding Sources of Information to Trust. Our Research is 100% independent which is why you pay for it. Our goal is to make you money. Then you will keep coming back.

7.7 million

Australians invest in the Stock Market

58%

are men

42%

are women

1.7 million

Started in the last 2 years

12 years

Under the Radar's been delivering quality stock advice

70%

On average 7 out of 10 of our Small Cap Stocks outperform.

10 Stocks

Under the Radar's weekly Best Small Cap Stocks To Buy

1,000%+

Under the Radar's average return from our Best Stocks list!

Video: Stocks of the week from Rich

This week's market update. Have a Friday beer with Rich and find out what's happening in the market and updates on our stocks.

Why Under the Radar Report subscribers make money

We love finding and recommending fast growth ASX companies while they are still undervalued. We focus on dividends + capital growth.

Stock selection

10 Best Stocks to Buy

The best part is our stock experts give you a weekly deep dive in the 10 latest Small Cap shares to buy. Beat inflation and discover value businesses operating in a wide range of markets and sectors while they are still cheap. Get in earlier than everyone else. The point is our experts are known for their stock investing and ahead of the curve ideas. We report on revenue generating, value companies operating in a wide range of markets.

Build a balanced portfolio

Risk Rating

How risky is a stock? We give you a risk rating for each of our Small Cap stock so you build a balanced portfolio of ASX shares.

Industry experts

Expert, independent advice

Our sector specialist reports drive your deep knowledge of the markets and stocks that you invest in.

Keep up to date with our latest news

Learn more about investing in ASX Small Caps and the best of the top 200 Companies.

Small Cap News

Sector Reports, Small Cap News

Stay up to date with the latest in ASX Small Cap investing

Small Cap News

Sector Reports, Small Cap News

Stay up to date with the latest in ASX Blue Chip investing

Blue Chip + Small Cap Report

Find out more and start investing

Grow your wealth in the Stock Market and Start Today!

Stocks Trading Under $5

50% of our small cap stocks are under $5 when we first recommend them and many are under $1. But the don't stay small!

We research quality small caps while they are still undervalued and before they are household names. Over 50% pay dividends. They often operate in a niche or are a future disruptor. (Think Afterpay which we tipped at $2.51!).

The stocks we specialise in are under-researched and rarely in the news. Find the hidden gems on the ASX now.

Sometimes betting on one person can pay off. This company has delivered over many quarters and now has a market cap in the billions. It is a true star stock.

We first recommended the company MAQ in 2013 around $8.00. Our clients who stuck with this stock made many times their cash investment.

Our analysts liked this company because of its business model and cash generating ability. We saw a rising star stock. In 2020 we told subscribers to buy for its expected strong capital return.

Clear, concise investment report that offers alternative options.

Aaron Rosada