Getting started with the stock market

Investing in shares can seem daunting at the start and in our experience, the hardest step is hitting buy on your first share. Here is our 3-step guide to help you start investing in stocks today.

Set your investment goals

Having an investment plan when you first start investing in stocks is critical before putting your own money into the stock market.

Set up your brokerage account

While there are some full service brokers, you can place your own buy and sell orders using brokerage services.

Choose a stock to buy

Once you've setup your brokerage account, it's time to start building a diversified portfolio by selecting the right investment products.

Building Wealth From Scratch In The Stock Market:

Build a thriving share portfolio with our 12 month step-by-step system. Just $99 for the full easy to action program.

Opening a brokerage account online

One of the first steps to start building an investment portfolio is choosing an online trading platform and then setting up a trading account. You can use a full-service stockbroker for buying and selling individual stocks or an exchange traded fund but most beginners and active investors now make the trades themselves from their online account on an app on their phone. If you are a beginner, our stock investing guide is a must for you as you start investing in shares. Understanding investing basics is key before you enter the stock market.

Plan your diversified share portfolio

The gold standard for standard investment advice is that it's important to diversify. You don't put all your eggs into one basket. For shares it means owning shares in a number of different companies that operate in different industries.

For you, that might mean investing directly in stocks, mutual funds, exchange traded funds, or index funds.

When you invest in stocks, this is a proven way to reduce your risk.

By doing this you reduce your exposure to market volatility. It is a good idea to be aware of your own risk tolerance levels.

It's ok to start with one stock and to build up your portfolio over time. It all depends on how much cash you have.

We recommend a minimum of 7-15 small cap stocks in any portfolio.

Follow our guide on how to build a portfolio.

Take control of your investing

If you want to start investing in shares now check out our best blue chip stocks to buy now

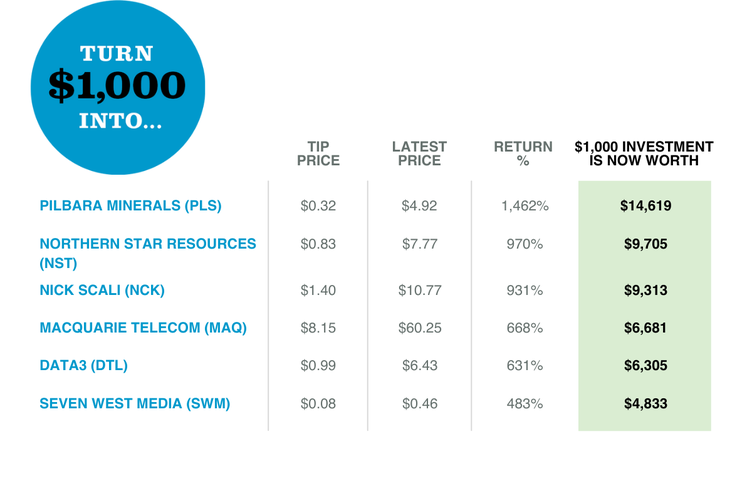

Can I start investing with $1,000?

Start your share investing with at least $2,000 as recommended by the ASX.

In the share market, Small Caps are cheaper and you can buy a meaningful parcel with less cash.

Over 90% of our small cap stocks had a market price of less than $5 a share when we first recommended them. Over 50% pay dividends too.

You can start with a minimum of $1,000 and purchase one stock with that. Build up a share portfolio over time.

Investment advice for beginners

Our best financial advice to beginners is to start small and to purchase small parcels of shares in quality companies over time.

What are your investment goals?

Consider your life stage and your risk profile. These questions will help you decide which how your stock portfolio should look like, the shares you should buy buy and what your investment objectives should be. Find out how to build a portfolio now.

Start small

Build up your portfolio over time. We like to buy slowly into a stock and to build confidence. Start buying in small parcels, watch your portfolio's performance (it’s really easy on your trading app) and follow our clear Buy, Sell and Hold recommendations. We tell you what to do and when.

When the stock market moves

During Covid-19 in 2020-21 when the market was falling fast, we chose 20 quality small companies that had strong balance sheets and business models in industries that would survive a downturn. Our subscribers who followed our advice made record returns.

Be Prepared

Remember not every stock will go up, so you should build a portfolio approach. It's also important to sell and to take profits along the way.

Seek Independent Advice

There are over 2,000 shares listed on the stock market. Most people are looking to reduce risk and build wealth over time. To reduce risk, beginners need independent research to know the company you are investing in is a quality company that is well run and profitable. You want to make quality investments and we can help you do that.

Best Stocks to Invest in

Our Best Stocks to Buy Now table in our Small Cap report each week makes it really easy to search and choose which stock to invest in. These are the stocks that our analyst team believe offer the best risk/reward return. The performance from these stocks is exceptional with 1,113% return! All the research is done with easy to read and clear recommendations and potential risks, reviewed and ready for you.

Dividend Stocks

Did you know all of our Blue Chips and 50% of our Small Caps pay dividends! Take out a free trial to see our best dividend stocks.

What You Get With Us

When you start your 14 day free trial or you upgrade to a paid subscription you have instant access online.

Our Small Cap reports come out every Thursday morning.

Our Blue Chip reports come out every second Friday morning.

We cover 100 stocks - you can’t possibly follow them all, but head to our best buys to find the stocks we like right now.

We then give regular updates for the subscribers who own them so they know when to buy, sell and hold.

We cover 12-24 new stocks every year

Follow our Small Cap portfolio to check out how we have set up a winning small cap focused portfolio.

What's the right size holding for you?

If the share goes up 5%, 30% or 100% what would your return be? Is a $300 profit on a $1,000 profit if for example there is a big 30% jump enough? Consider what is the right size of holding for you.

The Idle Speculator, Under the Radar Report Portfolio Manager.

How to place a trade on the ASX: A Step-by-Step Guide

Here are some basics to get you started when you are placing your first trade on the stock market. Choose your stock, look at the share price and hit buy, then you will then have a few options to select:

Buy: quantity or value

You can either choose a quantity of shares i.e 100 or 1,000 or purchase by amount, i.e $1,000 or $2,500.

It is a personal preference whether you trade shares to the nearest round dollar or by the number of shares, but most fund managers would own a round number of shares rather than a round dollar amount at purchase.

Price: Limit or market

This is what price you are prepared to pay per share. You can just select ‘at market’ and the trade will go through as soon as it can at the market price.

If you choose a limit you put in the price you are prepared to pay for the shares. Your share trading screen will have a depth screen to see the number of buyers, the volume and price and the sellers volume and price. This will give you a sense of where the market is heading.

Check out the price chart

Also look at the price chart to see how the price has moved over the past 12 months, 6 mths, 5 days, and that day. The charts show you the trend over time and intra day as well.

Expiry: good till expiry/ good for day

Are you happy for this trade to only go through today? Or are you happy with your trade at that price until it is executed? If you put in a price and the market moves on from it, your trade may not go through on the day you put it through.

Fluctuation in share prices

What can be a surprise for a new investor is the range that each stock trades both within a day and over a period of time. For example, the Commonwealth Bank (CBA), one of the largest on the market has traded from around $60 to $95 a share in the last 12-months. It obviously also takes more capital to get a holding of 100 shares and the share price can and does move around.

Watch your shares

Watch your stock. Remember to make profits you have to sell. Follow our clear buy, sell and hold recommendations.

Isn't my money safer in the bank?

ASX Returns

Banks are a safe deposit for your money. But with record low interest rates, your money is losing value and is not keeping up with inflation. You need to make your money work for you.

The ASX historically goes up 9 out of every 10 years.

Investing in shares makes your money work harder for you. It will build wealth while helping you with your financial goals. It is an opportunity to earn a better income and a chance for capital growth. The post Covid world remains uncertain. Think what your future self needs. Then decide if you can afford for your money to sit in the bank? Your investment decisions today can shape your tomorrow.

Key Takeaways - Taking the first steps

We're here for you

Set your investment goals

Are you investing for growth and dividends?

Independent analysis

Go to our best stocks to buy now.

Earn income with dividends

50% of our Small Cap stocks pay dividends. 100% of our Blue Chip stocks pay dividends.

Why investors love Small Caps

Small Caps are cheap and offer fast share price growth.

A balanced portfolio

Blue Chips provide stability and returns in a balanced portfolio.

Buy, sell and hold

We tell you when to Buy, hold and Sell. You can't take profits without selling.

Take control of your investing

If you want to start investing in shares now check out our best blue chip stocks to buy now