Why you should invest in powerful Small Caps

Fast growth! Generate extra income from Small Companies with their share price growth and dividend payments.

Huge price rise potential

It's much easier for a Small Cap to grow 20-30% than a Blue Chip to grow by 5%.

Takeovers

1 in 5 of our Small cap Stocks are taken over, giving big price rises to investors.

Dividends

Money for you now. Dividends are payments a company makes to share profits with its stockholders. 50% of our Small Cap stocks pay dividends.

Cheap to Buy

Small Caps are cheap to buy so you don't need a lot of capital.

Cheap Diversification

Which means not all your eggs are in one basket.

Quality Companies

We do all the research and only find you the quality Small Cap companies.

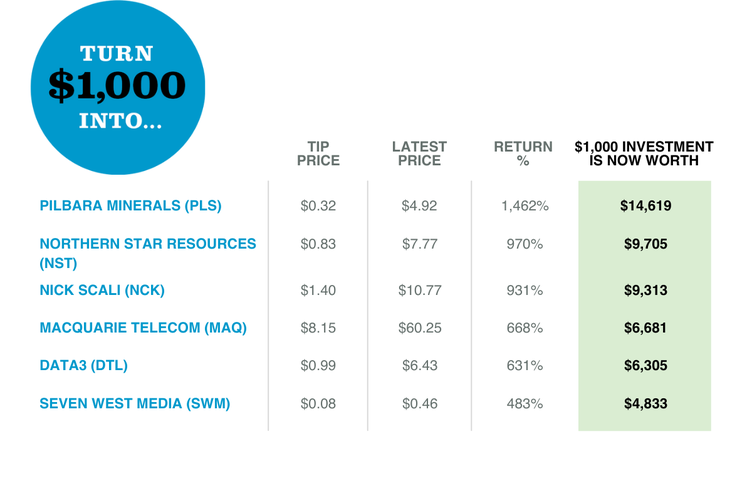

Turn $1,000 into...

Small Caps are Australia's global success stories. As they grow, they may double, triple and more, delivering you financial earnings now in dividends and share price growth.

Get 3 Free Stock Reports in the next 14 days

Stock reports delivered straight to your inbox PLUS immediate access to our subscriber only dashboard. 14 days free. No strings attached!

How you can grow your money with ASX Small Caps

Growing wealth is the main objective to start investing or trading in Small Cap stocks because they can deliver you outstanding financial results in the short and long term with a limited capital outlay.

Earn income with dividends

Dividends provide income half yearly and are often paid at a much higher rate than any bank interest rate.

50% of the small cap stocks we recommend pay dividends. They prove that the business is a quality investment and it represents an important price signal for the market.

Achieve diversification without a lot of cash to start

They also provide diversification at cheap prices. Diversification means reducing your risk by not putting all your investment eggs in one basket.

Low cost: Share price under $5

Many are cheap, costing generally under $5 to buy, so you can start and build up a portfolio over time without spending a lot of money. 50% of the small caps we recommend are under $5.

Reduce risk with diversification

To buy 100 CBA shares at $100 each you need $10,000. But if you invested that money into our recommendations you could invest $2,000-$2,500 in 4-5 different stocks that are positioned for growth. With your money spread across a few stocks you reduce your exposure and position your portfolio for success.

Finding Gems: Can I make money at this end of the market?

Yes you can and we can show you how.

There are over 2,000 companies listed on the ASX and there are some real gems in here. The trick is finding them! and that's our job. Small companies are under researched and rarely in market news. But this is where money is to be made on the ASX.

How many stocks should you own?

Our advice: 7-15 Small Caps in your portfolio.

Generate excellent financial results and beat the market with small caps. It’s this out performance that you simply can’t achieve anywhere else or with any other financial investment.

Always consider your personal financial situation or needs.

Find out how to build your own portfolio to ensure security for your family into the future.

How do I pick a Small Cap Stock?

You choose to invest in emerging businesses to make money. Getting results is all about picking the right one!

Choose the right stocks

To make money from shares you need to buy when it’s price and market cap are low before a big price spike so you don’t pay too much for it.

These shares are not in the news

We will show you well run small stocks. With experienced management, a catalyst to expand & the ability to enter new markets. Its financials stack up.

Our Performance

7/10 stocks we have recommended in the last 10 years have out performed. Our performance speaks for itself.

What are ASX Small Caps?

Small Caps are the the smaller companies listed on the ASX by size. The size is determined by market cap.

Why does size matter? What is "Market Cap"?

Market cap is important because it tells you how large or small the company is. Short for market capitalisation. The definition is simply the current share price x the number of shares on the ASX.

Under $50M

If a company is too small, liquidity is a problem. You could find it hard to buy and sell your shares when you want to.

Sweet Spot for Making Money

Size matters because stocks in the $50 million-$600 million market cap are in the sweet spot for making money.

$Billion+

At the billion dollar value it is hard to grow even 5-10%.

Why do takeovers matter?

"19% of 1 in 5 of our stock picks have been taken over in the last 10 years. Why does that matter? Because the share price rockets bringing big returns to investors."

Richard Hemming, Editor

What are some company examples of Small Cap stocks?

These companies were small when we first covered them. They initially listed on the ASX to access capital to fund expansion. Some companies we tipped with stellar performance include:

Kogan Pty Ltd (KGN)

Medical Developments Pty Ltd (MVP)

Evolution Mining Pty Ltd (EVN)

Macquarie Telecom Pty Ltd(MAQ)

Austal Pty Ltd (ASB)

What are ASX Penny Stocks?

Small Caps are also called Penny stocks, Growth Stocks, Emerging Companies or Micro-Caps. They are traditionally cheap and cost only a penny or a couple of dollars.

Are Small Caps riskier than large caps?

Generally they may be. But risk and return are related.

Advantages

The business is usually less complex.

It may operate in a niche or may bring new technology or a new financial product or service to market.

This can be a serious threat to large companies.

Risk

Liquidity - it may be harder to buy the shares as there are fewer shares on the market.

Depending on the industry they company operates in, they may be more prone to dip in a recession.

Advantages for investors

The biggest advantage for personal investors is that they are under researched.

They also sit outside the big ASX group of indices (eg the ASX 200 index) which means fund managers are not able to invest in them. But there is a lot of money to be made by individuals in this space.

Looking ahead: Success from niche industries

Emerging and niche industries bringing new technology to the market.

Successful companies in Australia come in many shapes and sizes. Often success comes from a niche, or a future facing industry. Sometimes the company is disrupting the way traditional companies do business, or are inventing new markets.

Diverse industries

Think Australia's healthcare, energy, mining, resources, medtech, funds manager, pharma and many other corporate activities.

Examples of Small Caps

The classic recent example being Afterpay (APT) but when they first listed you probably hadn’t heard of them. But we had! We first covered APT at $2.51! When they are still little they don’t cost much to buy and are not in the news.

Look at our Case Studies to see what Small Caps can do for you.

Companies that make news

Even BHP that now is a major player on the world stage was at one point a start up! The point is that they don't all stay that size and investors want to be part of their huge potential.

Small Caps are under researched in Australia.

Read more about our services and our 7 steps to picking small companies here. Ensure you set your personal goals and consider your objectives, financial situation or needs.

Under the Radar Report: AFSL 409508.

How do you get insights and know which stock makes a good investment? That's where Under the Radar Report comes in. We tell you what to buy and when to sell!

Great easy to use interface and very handy tips for picking the right companies to invest in!

Chris Jamieson