ASX WBC

Westpac Banking Corporation (ASX: WBC) is a multinational banking company headquartered in Sydney, NSW. The company remains one of the nation’s best-performing stocks in banking, a major contributor to its position within the top 10 largest Australian companies by market capitalisation.

Many savvy investors see ASX WBC as a preferential option for long-term returns. As a blue chip stock forecasted for continual growth, it remains a popular share option for first-time investors. Unlike small cap investments (which may provide significant returns over time), WBC is associated with regular returns and less volatile changes to its share price.

ASX WBC company overview

Westpac Banking Corporation was established in 1817 as the Bank of New South Wales. It remains the first and oldest of the ‘Big Four’ Australian banks, including Commonwealth Bank, National Australia Bank and the Australia and New Zealand Banking Group.

Although Westpac primarily focuses on consumer and commercial banking, it also provides corporate financing for national brands and global institutions. Its current market capitalisation remains over AUD 75 billion. Today, more than 14 million active customers rely on Westpac Banking to perform personal, commercial or institutional financial tasks.

Recent developments for ASX WBC

WBC strives to expand its organisation through multiple business avenues. There are now dozens of branches located worldwide, including select locations in Asia, New Zealand, the US and the UK. The company’s total operating income reached AUD 21 billion in 2021 and is only expected to rise.

Additional developments at WBC indicate product growth through strategic initiatives. Recent announcements reveal new programs to assist female business leaders, as well as simplified processes to positively impact customer experiences. The company has recently moved to take advantage of professional partnerships with PartPay, AWS and the NSW government.

ASX WBC share price and stock performance

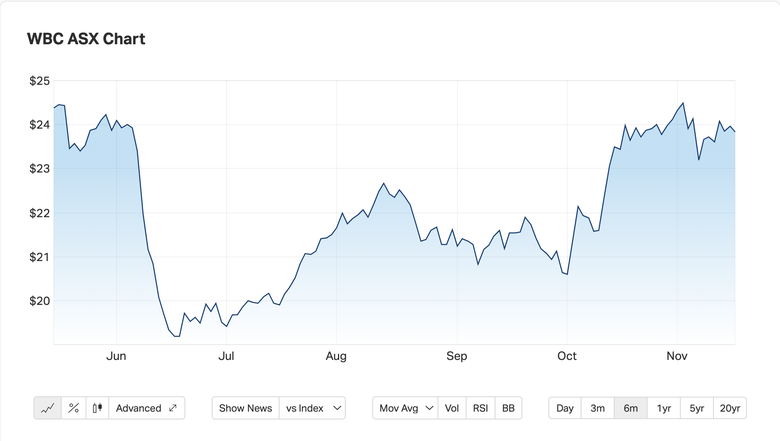

The WBC share price has shown a marked increase from its initial listing date in 1970. The lowest share price ever recorded was AUD 2.72 on 2 November 1992. In contrast, the highest share price on record is AUD 39.62 on 25 March 2015.

Analysts forecast a long-term increase in the WBC share price that may be well suited to investors with longer hold positions.

Banking and finance industry analysis for WBC ASX

Many investors see long-hold opportunities in blue chip finance and banking stocks like ASX WBC. Blue chips in the banking industry historically provide predictable dividends and may show steady growth over time.

However, WBC is not the only blue chip finance stock on the ASX. There are several other banking institutions with high market capitalisations, many of them direct competitors to ASX WBC. These include but are not limited to:

ANZ Group Holdings (ASX: ANZ) — Total market capitalisation estimated at AUD 71.63 billion

National Australia Bank (ASX: NAB) — Total market capitalisation estimated at AUD 91.02 billion

Commonwealth Bank of Australia (ASX: CBA) — Total market capitalisation estimated at AUD 161.26 billion

Other key players, including upcoming small cap banking stocks, remain potential opportunities for high-growth investors.

Future predictions for ASX WBC share price

The recent performance of Westpac Banking Corporation (ASX: WBC) suggests several new opportunities for investors. As blue chip stocks remain an important element of every diversified portfolio, they may provide a launching point for strategic small cap investors. It’s critical to remain informed to make wise decisions and complement any investment decisions with independent research and facts.

For a more detailed summary of ASX WBC and other blue chip stocks on the market, you may sign up for 14-day trial to get started for free — no credit card required.

We provide a weekly Small Caps Report and bi-weekly Blue Chip Value newsletter designed to help you make better decisions with institutional-grade research.