5 highest performing ASX oil stocks on the ASX

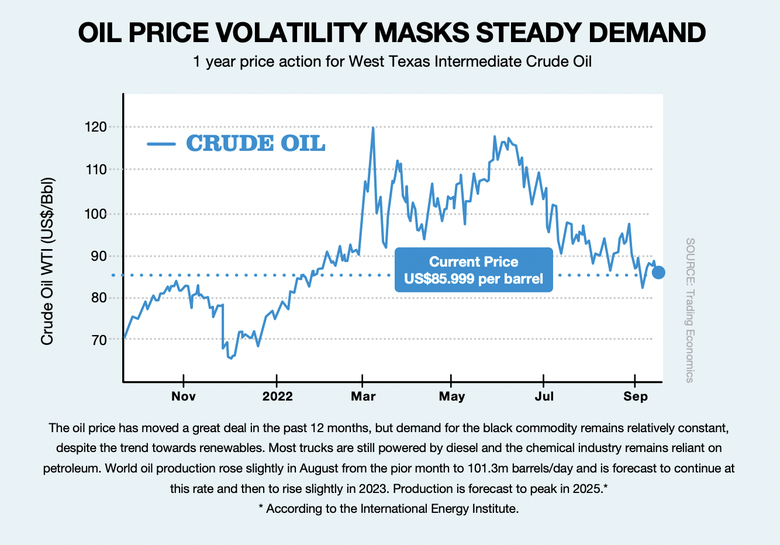

Oil demand continues to fluctuate on the ASX, although blue chip brands with high market caps continue to provide high returns.

The following oil stocks command some of the highest value by market capitalisation on the ASX:

Woodside Energy (ASX: WDS)

Santos (ASX: STO)

Ampol (ASX: ALD)

Karoon Energy (ASX: KAR)

New Hope Corporation Limited (ASX: NHC)

A full list of suggested oil companies is included in our weekly Under the Radar Report.

The benefits of investing in the best oil stocks on the ASX

Under the Radar Report demonstrates that oil stocks may remain higher for longer due to their netback prices. Combined with inflation, global growth and continued demand, oil stocks may provide many benefits to the wise Australian investor.

A few additional benefits include:

Attractive dividends: Economic uncertainty or economic and political events may increase dividends for hopeful investors.

Cheaper cost: Oil is cheaper than other forms of energy, meaning it remains a strong competitor to alternative fuels and younger energy competitors.

Share appreciation: When oil is in high demand, stock prices jump to accommodate the swell — padding your bottom dollar when it’s time to sell.

Understanding ASX oil stocks

Understanding the opportunities that exist in this market starts with a commanding knowledge of the crude oil industry — including stock options with the highest opportunity for growth.

Crude oil is a necessary component for current energy production and sees market demand all over the world. Once refined, oil can be used to create petrol in vehicles, as well as jet fuel, distillate and other products like asphalt. It is considered a nonrenewable resource, as there is a finite amount available to mine.

Investors could choose to invest in oil through mutual funds and ETFs. However, investments in oil companies that extract and produce oil may provide higher dividends and returns overall. A solid understanding of current events may help to better time the market, as well as intimate familiarity with new mining discoveries and current global demand.

The best time to invest in ASX oil stocks

Oil is tied at the hip to economic events and political uncertainty, which can make it difficult to time the market and project inflection points. That said, a solid understanding of ASX oil can help you make better decisions for the health of your portfolio.

As you work to build a profitable oil investment strategy, ask yourself:

What is the current outlook for oil? Despite the rise in alternative energies, oil remains a key element of the global energy mix.

What is my risk tolerance for investing in oil? Crude oil may be perceived as a less stable investment option that requires additional forethought and planning to time.

How long do I plan to hold my investments? Many investors choose to hold their oil shares for the long-haul and wait for opportune conditions to maximise their investments.

Learn more about the best oil stocks on the ASX with Under the Radar Report

Investing in oil could be an intelligent strategy for your ASX portfolio. If you’re interested in exploring some small cap opportunities and learning more about listings that fall under-the-radar, you’re welcome to subscribe to our weekly reports with 100% independent analyses. We employ seasoned experts with years of experience to cultivate investment opportunities you won’t get anywhere else.