The ASX mining sector has created serious wealth. From copper and gold to rare earths and uranium, mining stocks offer big opportunities — and big risks. So how do you get started without getting burned?

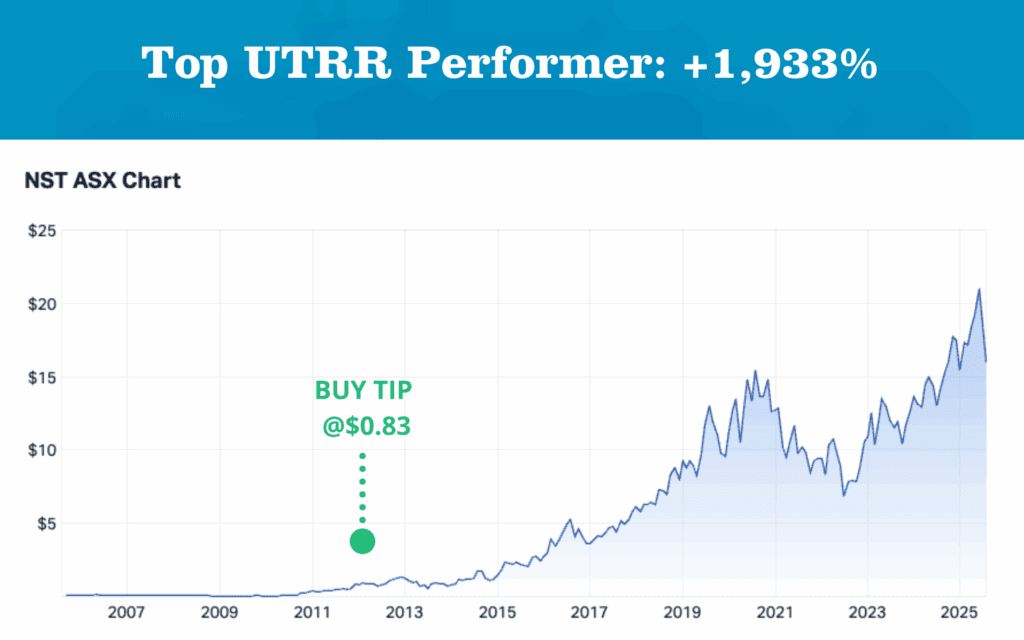

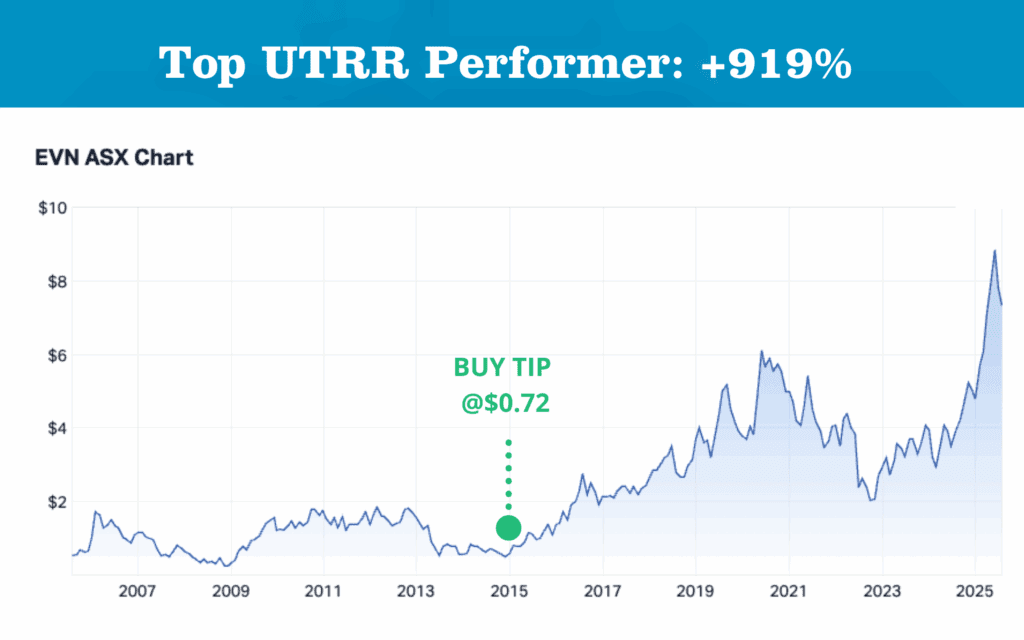

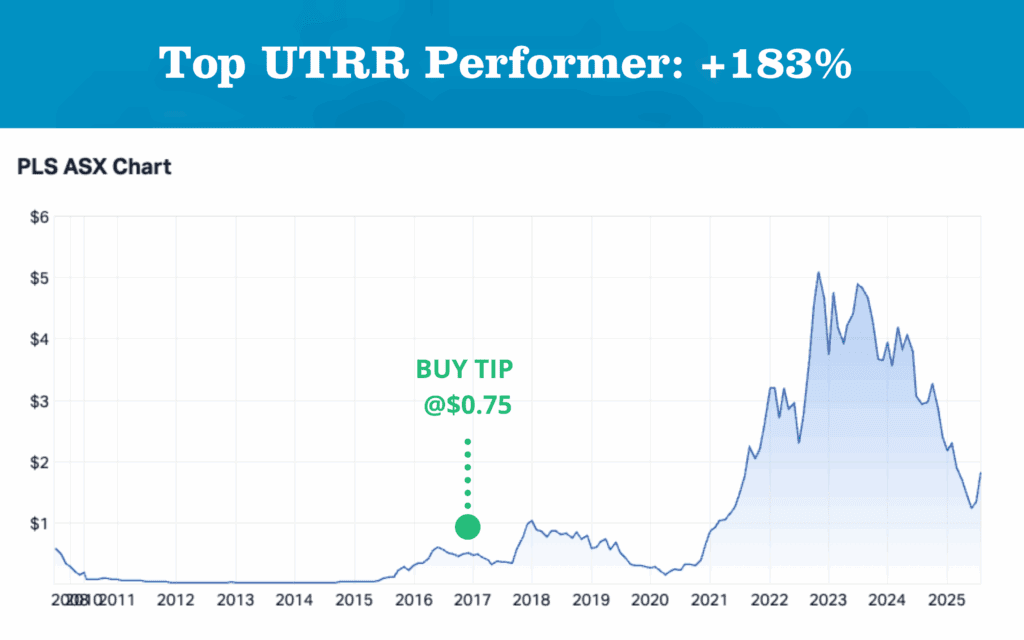

Richard Hemming shares 3 essential tips to help you invest smarter in mining — one of the most profitable sectors for Under the Radar Report and our subscribers.

Tip 1: Start Small, Then Build.

When investing in mining, especially single commodity producers, avoid putting in too much capital upfront. These stocks can be extremely volatile.

-

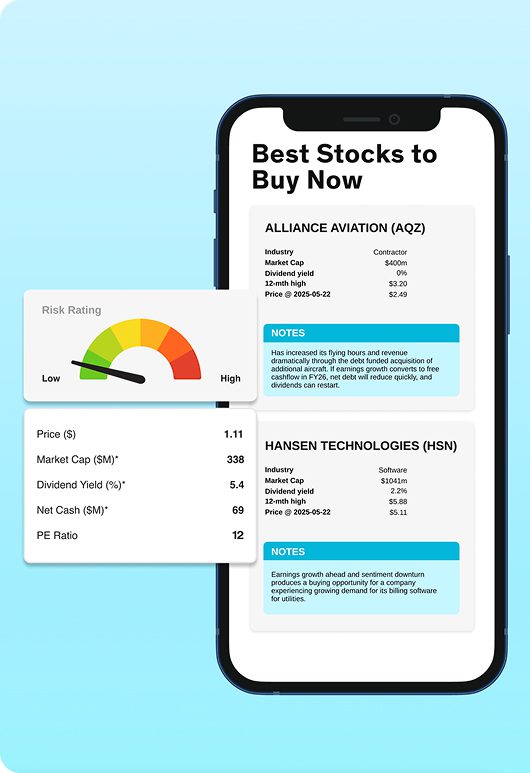

For diversified miners like BHP ($BHP), Rio Tinto ($RIO), and South32 ($S32), you can start with 10%+ of your portfolio.

-

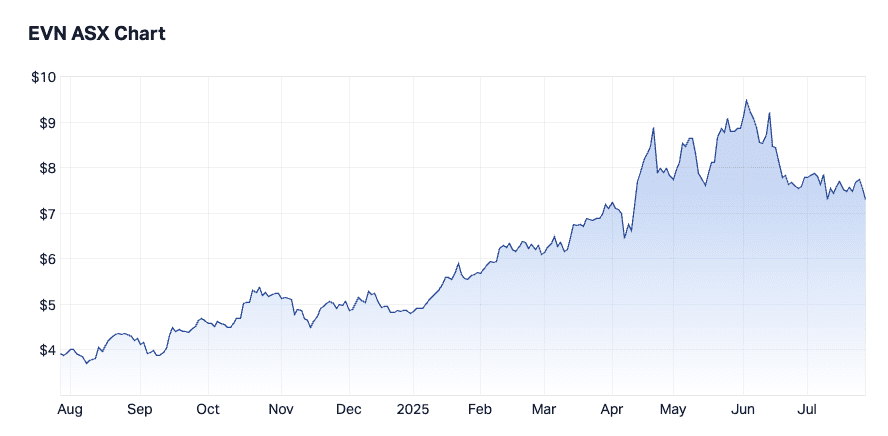

For smaller, single-commodity stocks like Evolution Mining ($EVN), Lynas Rare Earths ($LYC), or Capstone Copper ($CSC), start with less than 5%.

Use your portfolio weightings to guide decisions. Let them act as stabilisers — when a stock grows, take profits, just like we did with Evolution Mining.

Tip 2: Trust the research. Focus on the strategy.

Mining involves complex geology, engineering, and extraction science. You don’t need to master it all. That’s what our team of analysts is for.

Tip 3: Focus on Production, Explorers that only drill rarely turn into profitable investments. Size, production, and cash flow matter.