What are ASX Small Caps?

Are they a good investment?

As a small company grows, so does your wealth!

Owning Small Cap stocks will

What’s the difference between Small Cap, Mid Cap and Large Cap shares?

Find the hidden gems on the ASX

with Under the Radar Report.

Are Small Caps a good investment?

Should I invest in smaller companies?

Small Caps can provide some of the best investments because of their high growth potential. Check out our performance. Our track record speaks for the power of small caps!

What % of my portfolio should be in Small Caps?

Depending on your risk profile a minimum of 25% of your portfolio should be in small caps.

Many of the large cap stocks by market cap were once small!

Investing in these niche stocks now exposes you to much greater leverage then investing in giants later.

Invest in High-Growth ASX Small Caps

Ready to grow a strong portfolio with fast-growing stocks?

Accelerate with ASX Small Caps. With over 2,000 stocks to choose from, let us do the hard work for you. With our research, turn $1,000 into …

Turn

$1000

Into:

Small Cap

Tip

Price

Market

Price

Return

%

Afterpay (APT)

$2.51

$2.51

1.1%

$1,000

Paladin Energy (PDN)

$0.42

$0.42

1.1%

$1,000

Northern Star (NST)

$0.83

$0.83

1.1%

$1,000

Nick Scali (NCK)

$1.40

$1.40

1.1%

$1,000

Macquarie Telecom (MAQ)

$8.15

$8.15

1.1%

$1,000

Pilbara Minerals (PLS)

$0.32

$0.32

1.1%

$1,000

Get Instant Access

Choose the research that matches your investment goals.

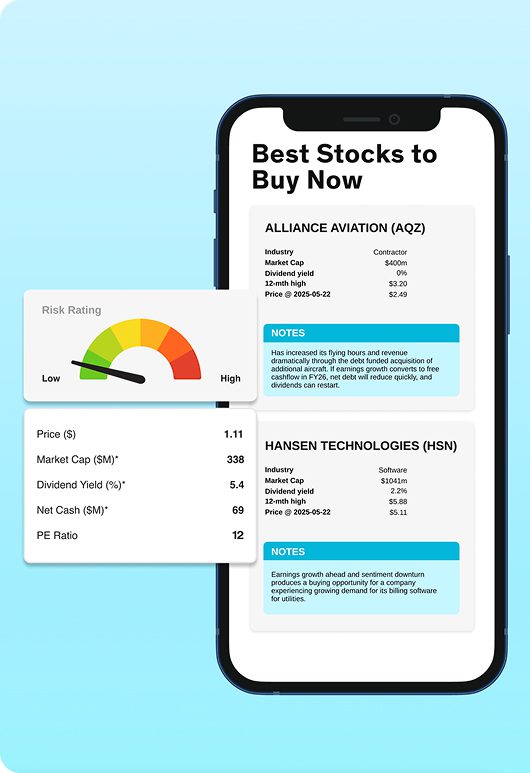

Small Caps Research

Total: $697

- Weekly Small Cap Report

- Accelerate with Small Caps

- 12-month Small Cap research

- Top 10 Best Buys: high conviction stocks

- Two dividend portfolios a year

- Research on 100 ASX Small Caps

- Buy, Sell, Hold + Risk rating

- 12 new small cap stocks a year

- Stock of the month

- Special sector reports

- Bonus fund manager interviews

- Exclusive dashboard

- Exclusive Ask the Analyst live webinars

- Sub Picks: we review your small cap stocks

Blue Chip Research

Total: $227

- Research on 40 ASX Blue Chips

- Buy, Sell, Hold

- Price Targets

- Magnificent 7 portfolio

- Macro-economic Analysis

- Income Generator: All Stocks pay dividends

- Bonus Quarterly Reports

Portfolio

Builder

Total: $79 $99

- 12-month step-by-step program

- Follow our Portfolio Builder Program to build your portfolio

- Build your portfolio from scratch

- Full course materials incl videos, ebook, workbook + more

- Recommend adding Blue Chip to Build your Core.

How many of our small caps have been taken over? 1 in 5 stocks. Takeovers deliver big share price spikes.

Richard Hemming

Founder

FAQs

Questions Answered

There are two main small-cap indexes to bench mark small cap stocks.

S&P/ASX Small Ordinaries index

In Australia look at this index for the small companies on the ASX. It includes all companies in the S&P/ASX 300, excluding those in the S&P/ASX 100. It accounts for 12% (November 2020) of Australia’s equity market. Remember to make it even onto the small companies index these stocks are no longer small! They are quality companies often producing dividends.

The Russell 2000 index

Is the US small cap index. It shows you how small companies are performing in the US market.

Because Institutional investors have constraints

One advantage of investing in small-cap stocks is the opportunity to beat institutional investors. ETFs and funds have internal rules that restrict them from buying small-cap stock companies.

They can’t invest until the company has already increased in value and enters into an index.

The Small Caps on the ASX are just too small for the big fund managers to put their funds into.

Fund managers won’t buy into any company until it reaches around $100m with the majority not even considering investing until it reaches a market cap of $500m.

This is a big advantage to individuals! it means that the share price of these Small Caps has had to have doubled, tripled and quadrupled before a fund manager will invest capital in it, with mum and dad investors riding the company’s shares outstanding success wave to get there.

And this is precisely what happens. A few examples are:

- AVA Risk Group (AVA)

- Tassal (TGR)

- BigAirAfterpay (APT)

- Zip (Z1P)

- Austal (ASB)

- Clover (CLV)

- Macquarie Telecom (MAQ)

- Northern Star (NST)

$AVAThese are just a few of our outstanding shares that were all Under the Radar Report stocks when no-one else was covering them or investing in them.

After a period of fast growth, fund managers become interested in small companies when the market cap reaches a key tipping point.

By which time, the share price has boomed and then the company’s share price often booms again as more fund managers buy in to the future performance.

Under the Radar starts coverage on stocks well below the index market cap requirements of the S&P/ASX Small Ordinaries. We look at stocks with a market cap of between $50-500m

Small Caps are more volatile and there is “information risk”. In these companies their historic earnings performance can often bear little resemblance to their future earnings. And so you need good research before you invest in them.

Checking the balance sheet, p & l, and cash flow, a strong management team, a growing customer base and efficient systems. We do the research so you don’t have to.

Our track record speaks for itself.

We have delivered big returns for members. Click here.

Our Stock Success Rate

7/10 Stocks Outperform

We don’t get every stock right which is why it’s so important to diversify.

Small Companies rarely attract independent analysis because they are too small. But the shares we have covered in the last 10 years have definitely been noticed now and have delivered big returns for our subscribers.

Our Take Over Stock Success Rate

1 in 5of our stocks have been taken over

These stocks have doubled, tripled and more in value. Some that no one knew about are now household names. Think Afterpay or Northern Star Resources. Most recently our lithium stocks are taking off.

But then there are all the small caps, that aren’t taken over but just succeed in their niche and become household names, or are success stories of their industries.

Our Results

Growth

You simply can’t achieve the kinds of gains that you can get in ASX Small Caps that you can through other investments.

At Under the Radar Report we advise structuring your share portfolio clearly and that up to 25% of your portfolio should be invested across 7-15 Small Cap stocks to diversify your portfolio and position it for growth.

Yes our research and stock picking is 100% independent. It’s not a press release prepared as a report! It’s serious hours of analyst time, researching and analysing each and every company and deciding if it is a quality investment opportunity.