Actions To Position Your Portfolio For 2023 And Beyond

Now that there has been selling in equities, the expected return of those assets has climbed. That’s right, there is now value. It will not be a smooth ride and company specifics will be the key to whether or not a stock finds favour, but the time to start bulking up your portfolio is now.

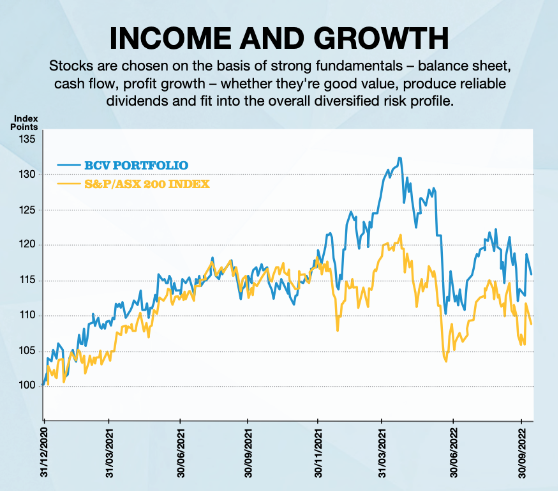

In our last rebalance (BCV116, 4 November 2022) we increased our weighting into stocks that our Blue Chip Vaue model showed were good value, with a priority given to stocks with strong balance sheets and a relatively certain earnings profile.

Balance sheets are always the key when there is market weakness. These companies can take advantage because they have strong capital reserves and aren’t reliant on a high share price to raise capital and make acquisitions.

If you are interested in learning more about the Small Cap Stocks and how to invest in this area read more here.

Actions for your Portfolio

You want to be owning robust companies, whether they are Small or Big Cap. Stocks that have genuine quality, both in terms of their balance sheets and prospective cash flow, proving that they don’t need to raise emergency capital; as well as prospects of growth, without paying too much for it. Investing in value is how you sleep easy at night, which is what we spend all our time looking for.

Find out which Blue Chips to invest in for 2023.

Economic Comment

Much of the economic news has been dedicated to rising electricity prices and the associated coal and gas price caps in the domestic market to alleviate the problem in the short-term. Still more news has been devoted to inflation and this week’s increase by the US Federal Reserve of the benchmark overnight federal funds rate to 4.25-4.5%; and indeed on rising interest rates in general. The fed funds rate is now forecast to climb to 5.1% next year due to an inflation rate that sits stubbornly above 7%.

Domestically, the price cap on gas and coal prices might dampen inflation in the short-term, but markets will look through this because the inflation genie is out of the bottle.

The key to all this for investors is perspective, which was underlined in this week’s issue of The Economist, whose lead article “The new rules” states that the need to combat inflation will dominate investor actions for the foreseeable future because higher interest rates are here to stay.

Although the article doesn’t mention it, the underlying premise is that Ben Bernanke’s global savings glut is receding. This means that pressure on interest rates is waning and we are in for a sustained period of higher interest rates than we’ve seen for the past decade (see graphic at the top).

Under the Radar's Portfolio as at 20 October 2022 (BCV Issue 115)

Under the Radar's Portfolio as at 20 October 2022 (BCV Issue 115)

One of the reasons there was so much speculation on crypto and an influx of listings via IPOs is that there has been, for a while now, an excess of the supply of savings around the world, reflected in very low interest rates, which have been at or near zero and sometimes even negative. In 2005 then Fed Reserve chair Ben Bernanke famously called this the “global savings glut”. Venture capital funds, pension funds, private equity and superannuation funds ran around looking into every nook and cranny for anything that looked like it might yield a decent real return (above zero).

We first alerted Blue Chip subscribers to the waning of this effect at the start of the year (BCV96 28 January 2022). Back then we said that investors were wising up and selling "Blue Sky” assets considered unproductive.

Conversely, investors sought value, in the form of real earnings, strong balance sheets and dividends. This trend has accelerated in 2022 and will continue well into next year as investors seek what you might call “short duration” assets that deliver certainty in earnings and dividends.

Access our Best Stocks to Buy Now!

Get instant access to our expert stock research and analysis. No credit card required just enter your email and you're away. 14 days free!

Investment Summary

Owning stocks is about investing in the future. The more confidence you have in the earnings resilience of the companies in your portfolio, the better.

The other key is that you don’t need to chase. The market will remain bumpy and there are opportunities to buy stocks at value prices. The biggest factor in your portfolio’s return is the price you pay.

We advocate buying a combination of defensive Blue Chips and Small Caps that have growth potential, without paying for much, if any, upside. Our teams spends its time looking for opportunities across the spectrum.

Merry Christmas from all the team at Blue Chip Value. Our next Blue Chip Value Report is out on Friday 6 January.

Access our BIG ASX stocks to buy now for 2023. Just $20 a month! What are you waiting for?

For the Ultimate Guide to ASX Lithium Stocks

Access our BIG ASX mining stocks to buy now for just $20 a month! What are you waiting for?

Or access our Christmas deal and get 2 months free with our $199 annual Blue Chip subscription.