Star Stock Study: Data#3

Data#3

ASX Code: DTL

Share Price: $6.18

Market Cap: $944.6m

Dividend Yield: 3.1%

Net Cash: $150m

Delivering big share price growth and big capital returns

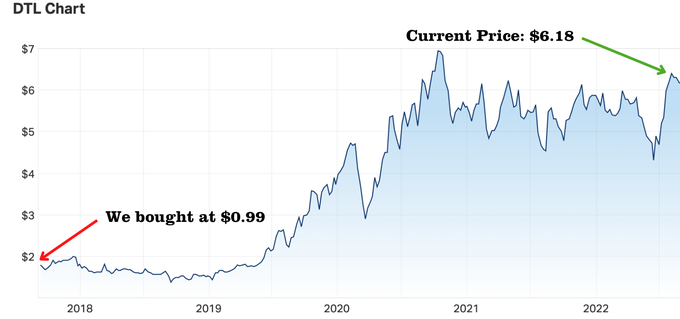

Our analyst team first recommended Data#3 (ASX: DTL) at $0.99 giving subscribers more than a 500% increase in value. Our last recommendation to our subscribers was to buy in at $4.53, so far returning 35% in 2 months.

Access our favourite ASX Small Cap stocks today. Join Today!

What’s DTL’s key to Success?

DTL’s strategy has remained relatively unchanged over many years in a rapidly evolving landscape: supporting large customers through complex digital transformations.

The business has 5000 customer accounts. Average revenue per customer has increased steadily to around $1m a year. DTL specialises in security, which is is its customers’ highest priority.

Ideally, DTL progresses naturally through a customer’s life cycle, commencing with consulting and project design, leading to project implementation, which drives demand for support services at the back end.

The IT service provider’s competitive edge is security and securing scalable solutions. DTL’s ability to retain and upsell customers stands out.

Always find out latest Buy, Sell or Hold recommendation before you jump into any stock.

Always find out latest Buy, Sell or Hold recommendation before you jump into any stock.

Access our latest value stocks to Buy. No credit card required just enter your email and you're away. 14 days free!

What Does the Future Hold for Data#3?

The FY23 outlook remains very positive, primarily because DTL is able to grow profits quickly on a relatively fixed cost base, delivering it operating leverage. The group’s broad portfolio of solutions provides for cross selling opportunities. Supply chain constraints will continue, particularly in networking hardware, but in theory they are easing. Utilisation levels are as high.

Vendors are shifting incentive programs to favour quality over volume. Wage inflation is being passed on programmatically to customers, who are willing to pay for superior service and are probably experiencing the same problem themselves.

Vendors are shifting incentive programs to favour quality over volume. Wage inflation is being passed on programmatically to customers, who are willing to pay for quality, and are probably experiencing the same problem themselves.

What does this mean for Investors?

The price of the stock is still below our valuation. Moreover, we think it continues to be good value, paying dividends and with double-digit earnings growth into the future. With steady profit margins, and consistent dividend pay-outs Data#3 is a quality Small Cap.

Start investing successfully in fast growth ASX Small Caps now with Under the Radar Report.

More about ASX Small Cap stock Data#3?

Data3 has impressed over the past 40 years by understanding the practical IT needs of corporate and taking advantage of niches in the digital market. DTL has long abandoned the software resale field like other companies in IT services, instead transforming its business towards software management services. However, it has also found a new niche making money from big corporates transitioning to the cloud.

As an Australian IT services and solutions provider, Data3 is focused on helping customers solve complex business challenges using technology solutions.

It has notably allied itself closely to Microsoft and it is the only Australian company to have a representative on its global advisory board.

"Show me a great business sure, but I will only buy it at the right price."

Our goal is to recommend great businesses, when they are at the right price

SUBSCRIBER TAKEOUT

Subscribe now to get the key actions for ASX investors to take!