What ASX Gold Stocks Should you Invest in?

The gold price has been buoyant over the second half of 2022, as investors look forward to the time when the US Federal Reserve stop raising interest rates. Our analysts have put their heads together to analyse the drivers of the gold price and how to profit from it. This is, after all, the hedge that has withstood the test of history!

Why Gold has been Bouncing Back

In line with the financial crisis price action, gold fell with other asset prices as stocks and bonds were sold off and interest rates climbed in 2022.

But the yellow metal has outperformed as other asset prices continued to decline, with Bitcoin failing to deliver any hedging function, which has disappointed crypto bulls. Bitcoin has been recovering over the past few weeks, but perhaps some natural sellers are unable to access their coins to sell.

Gold provided an effective inflation hedge during the last period of high inflation in the 1970s, running from US$35 when the US effectively ceased to allow automatic convertibility, the shiny metal soaring above US$800, before going quiet for 20 years when it bottomed around US$250 before rising again into the 2007/8 financial crisis.

More recently, central banks have been buying gold after the accessibility of US dollar reserves was brought into question after Russia invaded Ukraine. The uncertainties and global forces which that event unleashed have provided further reason for investors to think that a proportion of their portfolios should be hedged against any nationalistic interests.

Exchange Rates are the Key

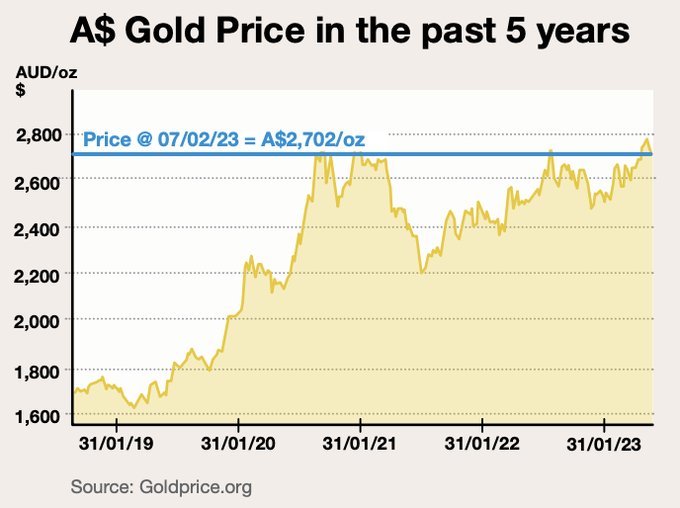

Gold is an international traded commodity which is most regularly quoted in US$, but not exclusively. In Australia, it is regularly quoted in A$ because of the large domestic gold mining industry in Australia. But gold is actually tied to a basket of currencies. The price may be relatively stable when expressed in one currency because that currency is itself stable. Or the gold price may appear to be on the move, but it may be the currency it is being quoted in that is moving instead.

Gold is an international traded commodity which is most regularly quoted in US$, but not exclusively. In Australia, it is regularly quoted in A$ because of the large domestic gold mining industry in Australia. But gold is actually tied to a basket of currencies. The price may be relatively stable when expressed in one currency because that currency is itself stable. Or the gold price may appear to be on the move, but it may be the currency it is being quoted in that is moving instead.

Various factors can impact the gold price, but currency usually predominates. The recent move up has been due to reduced availability of US$. Inflation and interest rates are also important.

There can be an inverse relationship between the gold price and the currency it is being quoted in. If the US$ is strengthening for instance, the gold price may be anchored by its value in say, Euros or Yen, causing the gold price to fall in US$.

In 2022, a rising US$ was largely correlated with a falling US denominated gold price.

Throughout most of calendar 2022, the US$ currency index (DXY) was rising. This index tracks the relative value of the US dollar against six foreign currencies, with the Euro and Japanese yen carrying the largest weights. However, for most of the year the US$ denominated gold price was falling, from a peak of over US$2,000 an ounce to a low of around US$1,620 an ounce.

What Does this Mean for Investors?

The likelihood for further US$ strength due to ongoing rate rises by the Federal Reserve, implied in the speech this week by US Fed Reserve Governor Jerome Powell highlights that the momentum in gold will be sustained. We also anticipate ongoing central bank support.

More certain than this, however, is that volatility will remain high. In early February the US$ denominated gold price experienced a sharp US$100 an ounce correction coinciding with a sharp rally in the DXY from around 100 to almost 104, caused by the surprise that interest rates should keep rising.

The key takeout for investors is to invest in gold stocks that have relatively low costs and growing production. This lies behind the recent mega-takeover attempt by US based Newmont for ASX listed Newcrest Mining (ASX:NCM). When you grow your production, generally your unit costs fall, which is why Under the Radar Report favours current producers with a number of mines, rather than high risk explorers.

To see our favourite Gold stocks

Join Now for only $59 monthly, including buy, sell, & hold recommendations and expert analysis for high potential ASX gold stocks.