Small Caps Grow

Remember that it's much easier for a small company to double or triple in value than for a Blue Chip to grow by 5-10%. Small Caps are growth stocks and when a small company grows, so does your wealth!

It's time to accelerate with Small Caps

Activate Today!

Start Investing Confidently in the Stock Market today.

Our top 10 investing lessons from our top 10 stocks

We love investing in Small Caps. See what returns you can get and what we think the key takeouts are.

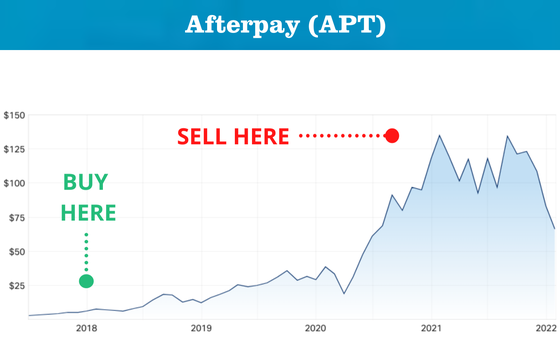

1. Afterpay (Returned 7550%)

Don’t be afraid to make a bet on a small disruptor.

We first covered APT stock in May 2017 (Issue 242) at $2.51 in an issue where we were covering shadow banking and two nascent players, Afterpay and ZipMoney. The term buy now pay later wasn’t even used for these point of sale entrants, whose aim was to offer a better experience for customers and merchants.

They’ve certainly done that for shareholders! Back then its market cap was $450m, with net cash of $21m. The Square Inc purchase price is worth $40bn and Afterpay’s price is close to $127. There was a great deal of uncertainty at the time we covered it, but the lesson is to jump in on occassion with a small bet on a little stock in a fast growing industry.

2. City Chic Collective (Returned 1245%)

It's often better to hold on when the going gets tough.

City Chic Collective was called Specialty Fashion when we first covered it. We liked the stock because it had a strong franchise and was growing its sales. Then trouble hit with the stock weighed down by 1100 Australia wide stores and too many brands. In late 2018/ early 2019 the company kicked out its management and restructured, selling most of those stores and brands to Noni-B, which is now called Mozaic Brands (MOZ). What has emerged is a slick online focussed retailer with a slimmer bricks and mortar presence of closer to 100 domestic stores targeting the relatively underserved market of plus size (14+) young women’s fashion in Australia, the US and Europe. The company is a leader in its market with an enviable digital presence. The lesson is that when a company falls on hard times, don’t sell! Hold on because often there is light and in this case, fashion retail gold.

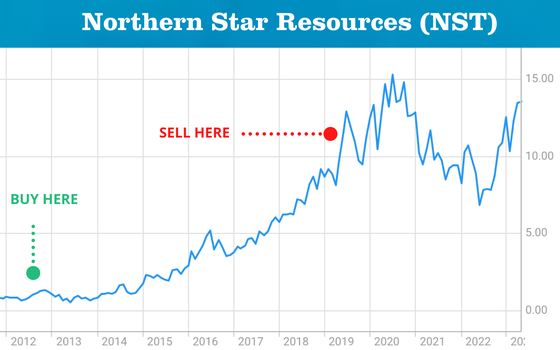

3. Northern Star Resources (Returned 1167%)

Sometimes betting on one person can pay off

Think about this, when we first covered Northern Star, back in June 2012 (issue 19) the company’s market cap was just over $300m, it had one gold producing mine in the middle of WA - Paulsens – and it was led by a workaholic 37 year old Bill Beament, who has a background in underground mining contracting. We were impressed with Beament’s mining ability, but not his company’s communications. Consequently we saw an opportunity after it missed production guidance. We could see that this company had strong fundamentals - $85m in cash; and incentivised management. Two very potent combinations.

1 in 5 of our Stocks have been Taken Over

Banking Big Returns for Subscribers: Start your free trial and access Small Caps to purchase the top stocks to buy now.

Our top 10 investing lessons from our top 10 stocks

We love investing in Small Caps. See what returns you can get and what we think the key takeouts are.

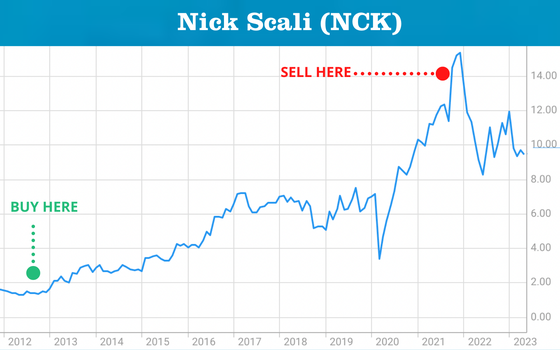

4. Nick Scali (Returned 944%)

More often then not the time to buy is when everyone is selling.

This was the case with Nick Scali in October 2012, when the stock was trading at $1.40. Our view was that Nick Scali had the brand and balance sheet strength to take advantage of weak trading conditions. We expected earnings would increase from its store rollout program, lower rents and positioning itself across different price points. This would make it well placed to benefit when the inevitable upturn in the housing market occurred.

5. Zip CO (Returned 931%)

In a fast growing industry it often pays to back more than one horse.

When we covered nascent shadow banking stocks, Zip Money as it was known then stood out along side Afterpay because it's model was based on disruption at the point of sale for retail. The big market at play was millennials who were the great unbanked. Zip had a proprietary technology providing fast and easy online approval and was experiencing increasing adoptions from consumers and merchants. Similar to Afterpay, which we preferred because Zip is more like a wallet. In the event if you bet on both you would have done exceptionally well and if you had only bet on one, their returns speaks for itself.

6. Macquarie Telecom (Returned 882%)

Patience often pays off with founder led companies

Macquarie Telecom’s success seems inevitable now, but when we first covered it we wore quite a bit of pain for over 12 months. When we spoke to CEO David Tudehope a number of years ago he evinced frustration that his company’s transformation from a telecom reseller into a software as a service cloud operator wasn’t being reflected in a growing share price. The company’s model is capital intensive, but because of its founders, MAQ has rarely raised capital and it has invested heavily on customer service. That investment is still paying dividends, right now through growth because they’ve stopped paying them!

Best Stocks for you

Remember to start with your own investment plan, considering your life stage.

Experienced Investors

Start accessing our Small Cap stocks. We cover over 100. If we don't cover a Small Cap you like, email us and our analysts will review it in our famous Sub picks!

Best Stocks for Beginners

If you are just starting out buying shares we've got you covered. Check out our Beginner's guide to get started now

Best Stocks for Retirees

You're after dividends + preserving your capital. Blue Chips are known for being a safe bet + they pay dividends. Don't rule out Small caps they can also provide solid dividends above 5%. Half of our Small Caps also pay dividends.

Traders

Our Buy, Sell and Hold recommendations are written with the aim of investors holding a small cap for a few months to years but lots of our subscribers use our stocks to trade in and out of for super quick returns.

Our top 10 investing lessons from our top 10 stocks

We love investing in Small Caps. See what returns you can get and what we think the key takeouts are.

7. CODAN (Returned 855%)

If you get it wrong initially, hang in there (and even buy more).

When we first covered this home grown communications technology we were very impressed with its innovation and its products. The company had one of the best selling metal detectors in the world and a strong position in long wave radio communication. Then we were blindsided by a downgrade after postitive news soon after its AGM. That downgrade was due to a civil war and wet weather in Africa, where its gold detectors were running hot. At the time of the downgrade we said: too late to sell, “you are in it for earnings which should revert to their normal run rate”. They did that and more. Holding on in the face of a storm is essential. Sometimes you should buy more.

8. Pilbara Minerals (Returned 687%)

If you don't get it right the first, you can get it spectacularly right the second, third, fourth, fifth...

We were intially positive on lithim in late 2017 but then backed off two years later amid mounting losses and increasing cash calls. Then we went back in with a vengeance in October 2020, which has paid off handsomely. We continue to like the price outlook for lithium due to increasing demand from battery manufacturers, catering to the ramp up in Electric Vehicle sales. PLS has a particularly impressive project because its production is increasing, following its opportunistic takeover of Altura’s neighbouring project. Its Pilgagoora mine has a long life low cost of production and big contracts with battery manufacturers.

9. Collins Foods (Returned 587%)

Hang in there when you believe in your investment thesis.

Collins was over ambitious when it listed, having been pumped up by private equity and sold. We liked the defensive nature of the business and held our nose. As it happened the company delivered a profit warning soon after listing, which was a disaster. But also a buying opportunity. When you are confident in a long-term story, you need to either hold on and/or buy more.

10. Evolution Mining (Returned 518%)

Backing the man, not the ball has been a gold winning strategy.

While Northern Star's Bill Beament has been the mining expert, Evolution's Jake Klein has been the gun at buying and selling gold mines, which befits his background as a banker. We first covered Evolution Mining in early 2015 at $1 but actually upgraded a few months later when it got to around 70 cents. In the end, the timing wouldn't have made much difference, because the shares have performed spectacularly well.

Invest Successfully with our Stock Reports

Start your free trial and access Small Caps to purchase.