Penny stocks form an important part of any diversified investment portfolio, with the potential for high returns - provided you can reduce the risk.

You need constant, ongoing stock advice to invest successfully in this riskier space of ASX Penny Stocks, but the returns and outperformance are there. We deliver up-to-date technical research on these under researched stocks. Access our independent advice now.

GET ACCESS

What are Penny Stocks?

A penny stock is simply a stock or a company that has listed on the stock market that typically trades with a share price of less than $5.

But penny stocks can also trade on the ASX for as little as a few cents (or to be old fashioned, penny’s), and hence their name penny stocks.

Why are Penny Stocks a good investment?

ASX share investors are all after serious share price growth and a few small penny stocks that you buy cheaply can really transform the returns in your share portfolio by doubling, tripling and more.

Penny Stocks are cheap!

They are cheap to buy and you can buy a good number of different penny stocks on the stock exhange like the ASX without a big capital investment.

With a small $2,000 investment you could buy 20,000 shares at 10c per share. Then if the stock price rises to 15c you make a quick $1,000. For the same money you could buy 20 CBA shares.

But if your penny stock goes up to 50c per share you really have made a hot penny! turning $2,000 into $10,000. Now who doesn't want to do that. The trick is not to lose your original $2,000.

Penny stocks are known to be high risk. How can you reduce risk with Penny stocks?

Penny stocks are known to be high risk but you can reduce your risk and make a profitable investment.

You need quality stock picking by penny stock experts. It's really as simple as that. You don't want to just head to the casino.

It's only through fundamental analysis to rule out the dead beat stocks that you can build a watchlist of penny stocks that are positioned for share price growth.

To find out more about Under the Radar Report's independent analyst team and to access our 10 best stocks to buy, click here.

Most of the stocks we pick are under $5.00 per share when we first recommend them and many a penny stock that was less than $2.00 per share when we first recommended it has outperformed.

Best Penny Stocks to Buy

In our free 14 day trial you can access our best penny stocks to buy. Some people trade our small cap and penny stocks, others are investors and follow our clear buy, sell and hold recommendations.

We don't choose just the popular stocks. In fact, we look for the opposite!

Our team are looking for penny stocks with a cheap stock price, that have a solid underlying business, are well run by an experienced management team.

ASX Stock exhange

We only research penny stocks that are listed on the ASX securities exchange. We don't cover penny stocks or small caps on any other stock exchange.

Are Penny stocks called anything else?

Yes! Penny stocks are also called Small Caps or Small Cap stocks. Penny stocks are also called emerging stocks when they operate in an new or emerging business. They all mean pretty much the same thing.

Penny stocks literally means you buy it for a couple of cents or under $5. Small Caps are defined by how big they are, and penny stocks are always small caps too.

Investors need quality Stock Research when investing in a Penny Stock

It’s very important to be careful and to invest wisely and to get quality stock research. This is particularly important in Penny Stocks and at the smaller end of the stock market.

The small companies can be high risk because these penny stocks are often unknown and normally always under researched. They don't have teams of analysts pouring over their financials like you do with the Big ASX Blue Chip stocks.

Do you buy a penny stock because it's cheap?

A good benchmark is to look at the value of the company as a whole. The bigger the market cap the bigger the company.

Don’t buy a penny stock just because you are buying it for a penny. It’s not a gamble you are making. You can remove risk through proper research.

Whether you consider yourself a trader or an investor, you need to make sure it's not a gamble and to do that you need research eofre you place a buy trade on a penny stock.

Penny Stocks are renowned for their high risk profile. You often read about a penny stock that offers huge, unbelievable returns or at the other extreme that people crash out and lose their money. So is this true?

It is if you don’t do your research and if you really are only buying penny stocks and really are only a few cents and price alone has been why chose to hit buy.

How to find 100 of the best Penny Stocks Under $5 on the stock market?

It’s very hard to know which penny stocks to invest in. You've worked out that you aren't just going to buy penny stocks because they are cheap.

You value your money as an investment and you want to grow your share portfolio with penny stocks that aren't going to go bust.

All 100 of Under the Radar Report’s current recommendation of penny stocks were under $5 when we first recommended them. But they are not all penny stocks now! That is the point of penny stocks is that they offer real growth potential to really boost your portfolios return.

Another way to look at our performance is 7 out of 10 penny stocks that we cover make our subscribersa strong profit.

It's why our members stay with us for years. We are known to be stock picking experts in penny stocks because our expert analysts do proper fundamental analyst.

Look at our Best performing stocks to see the stocks that started out as penny stocks but are now star performers. Many have transformed into being household names. It's what disruptive penny stocks can do!

Join Under the Radar Report today

Start trading penny stocks

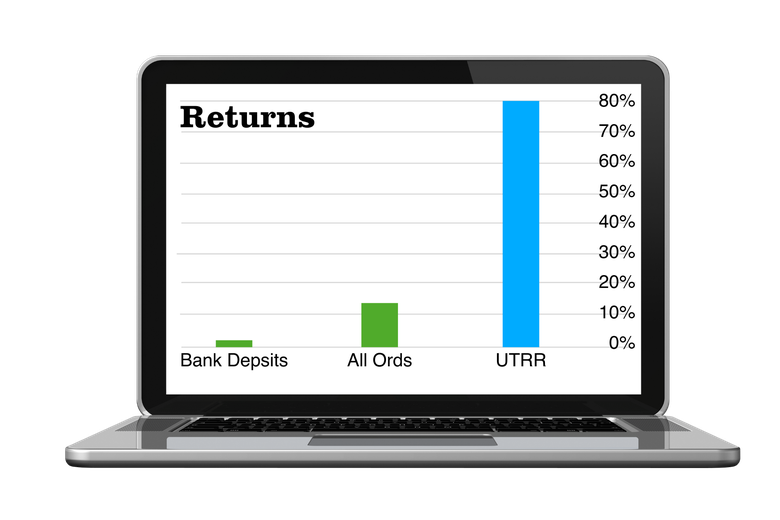

30% average return for all our 100 Penny Stocks

Under the Radar Report has been recommending small cap stocks on the ASX (or penny stocks) for over eight years.

Our average return for all our penny stocks is over 30% for the 100 stocks we cover. We tell you when to buy or sell. We make it really easy for you when you want to buy and invest or for trading penny stocks.

We only recommend a penny stock that is over $50 million in size. But as we said, all our small cap stocks that we have covered, or penny stocks to use a different phrase, were under $5 when we recommended them but they are not that now!

Should you be trading penny stocks? or do you invest for longer in penny stocks?

When people talk about trading penny stocks that mean that they are looking to trade penny stocks. They want to buy a penny stock, hopefully making a quick profit, (oh who doesn't love a hot penny!) and then sell out again.

Lots of our subscribers use our quality independent research for trading penny stocks.

They are not long term investors, and they like full use of their capital. They are looking for short-term gains and are trading penny stocks within a day, or week. Lots of people trade penny stocks successfully with our quality research.

Other people don't like to trade penny stocks as it puts a lot of pressure on you plus it is time consuming. Rather they are looking to invest in the best penny stocks, which means they are investing in a penny stock for a 1-2 years or sometimes longer.

The plan with penny stocks is to buy a stock and to give it time to establish itself in it's niche and watch it really grow. They sell out when we say take profits or sell.

So, what are the top 5 reasons to invest in Penny Stocks?

1. Penny Stocks offer growth and a strong investment return

When a company is small it is much easier for it to grow fast and to double, triple, quadruple or indeed become a 10 bagger because it is still small and starting from a low base.

This means for investors that your penny stock investment can double, triple, quadruple or much more easily from a penny stock than from a blue chip stock.

Growth is rare and hard to achieve in developed economies, which is why penny stocks can offer investors real growth.

2. Penny Stocks are cheap and more affordable

An obvious benefit is that you don’t have to put much money in to start with or you can buy a significant holding with much less capital than you would have to for an expensive blue chip stock.

Remember that investors need to take care with their share portfolio when buying a penny stock and that diversification is key and to know your own risk profile.

3. Penny stocks give you diversification

Following on from penny stocks being cheap, you can really diversify your portfolio across a number of different penny stocks to make sure you have a diversified portfolio.

This really means you are spreading your risk so that you don’t hold all your money in just one penny stock. Smart investors really do diversify across a number of different penny stocks.

We recommend that your share portfolio should have a minimum of 7-10 small caps or penny stocks, but certainly not less than 5. If you own less than 5 penny stocks you do not have a diversified portfolio.

4. Penny Stocks give your portfolio the boost that it needs

If you park your money in the bank, or just invest in blue chip stocks for their dividend yield your capital will remain stagnant and will not grow.

Investors need to consider investing a percentage of their portfolio into a number of penny stocks so their portfolio has the opportunity to really grow.

5. Penny Stocks allow you to invest in niche industries

Another great (and really interesting) thing that investing in penny stocks does, is that it allows investors to get to know small companies, often in niche industries that have cutting edge technology, or are a medtech stock developing new and exciting drugs.

You may be interested in exposure to Chinese markets and you find a penny stock doing just that, so you take that opportunity to invest there. Or you may find you are interested in lithium or in medical marijuana.

Subscribers at Under the Radar Report often give feedback that they learn about companies that they didn’t know existed that are punching above their weight and delivering exciting and interesting business models.

It’s why over 8 of our Small Cap stocks (nearly 1 in 10) have already been taken over in 2019 giving subscribers a real boost to their portfolio’s returns.

Click here for our latest penny stocks to buy and start trading in penny stocks today.