CommSec Executive Series: Under the Radar Report

Tom Piotrowski from CommSec interviews Richard Hemming.

Our top 10 Small Caps over 10 years

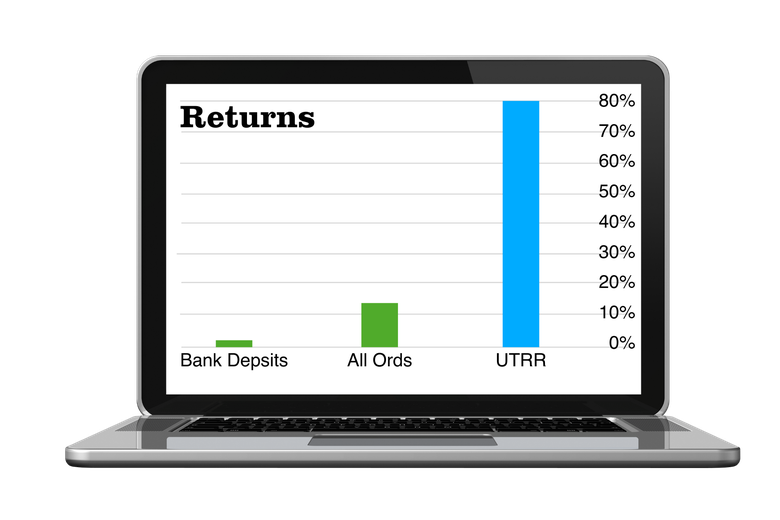

1,252% average return on the stocks from our Best Shares to Buy list!

The Best ASX growth shares to Buy for performance are Small Caps.

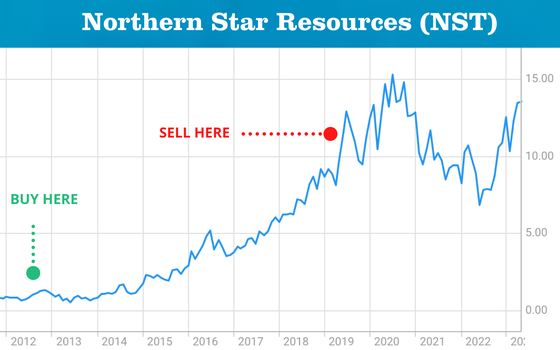

1. Northern Star Resources (NST) + 1,659%

First tipped at $0.83 now $13.70!

2. Pilbara Minerals (PLS) + 1,217%

First tipped at $0.32 now $4.15

3. Nick Scali (NCK) + 762%

First tipped at $1.40 now $9.35!

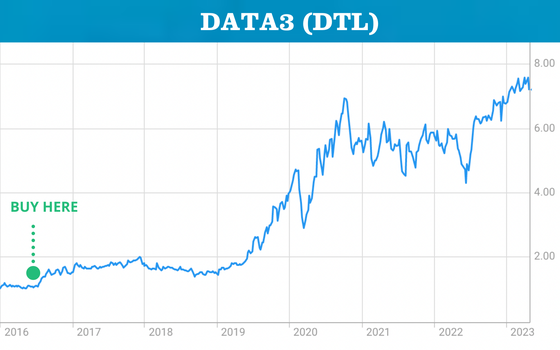

4. Data3 (DTL) + 683%

First tipped at $0.99 now $7.22!

5. Macquarie Telecom (MAQ) + 669%

First tipped at $8.15 now $60.29!

6. Evolution Mining (EVN) + 472%

First tipped at $0.72 now $3.62!

Building Wealth From Scratch In The Stock Market:

Build a thriving share portfolio with our 12 month step-by-step system. Just $99 for the full easy to action program.

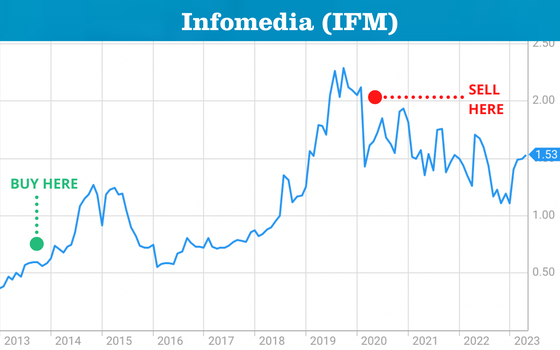

7. Infomedia (IFM) + 348%

First tipped at $0.47 now $1.47!

8. Clover Corp (CLV) + 346%

First tipped at $0.30 now $1.22!

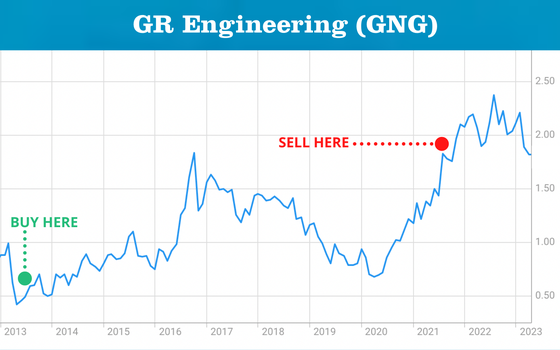

9. GR Engineering (GNG) + 319%

First tipped at $0.58 now $1.79!

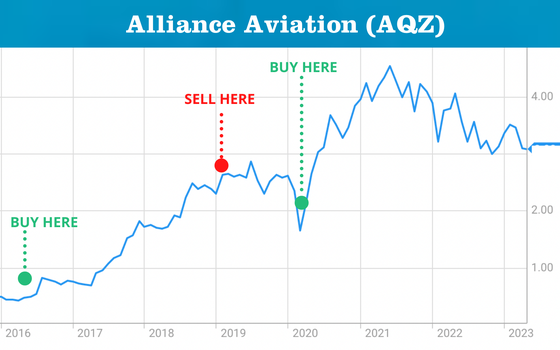

10. Alliance Aviation (AQZ) + 314%

First tipped at $0.83 now $3.07!

Start Investing Now with Our 10 Best Shares To Buy Now

Get into our research now. Start acting on our top ASX shares to buy for 14 days free. No credit card required just enter your email and you're away.

Why are ASX Small Caps the Best Stocks to Buy?

Being small, these stocks are usually cheap and have the potential for extraordinary growth rates. whats small on the ASX today, could be a large cap in only a few years. Giving investors unparalleled return on equity. Small Caps are also great for diversification. They operate in a wide range of industries from resources (gold, lithium, uranium etc) manufacturing, med-tech and more!

The best part? Small caps are usually ignored by the average fund manager, leaving the incredible growth potential to small investors.

Building Wealth From Scratch In The Stock Market:

Build a thriving share portfolio with our 12 month step-by-step system. Just $99 for the full easy to action program.

The Best Stocks for you: access the profitable world of Small Caps

Experienced & Active Share Investors

Traders

Just Starting Out

Retirees

ASX Mining Sector

We are very fortunate to have a serious mining expert, Peter Chilton, selecting the best stocks in the mining sector. Each week he updates our subscribers on the latest mining stock to buy.

Lithium

Power your portfolio with Lithium projects driven by tremendous growth led by small companies and quality management. No two lithium projects are the same. Follow our experts now.

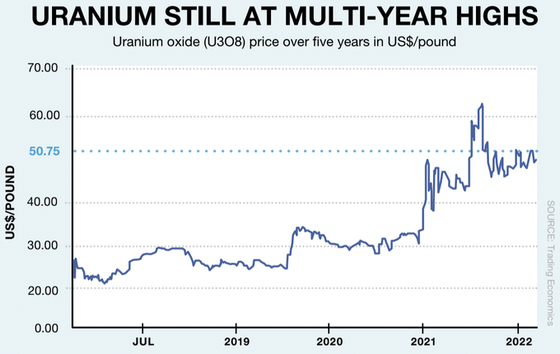

Uranium

Australia's known major uranium deposits are the world's largest – almost one-third of the world total. Read more to find our mining analyst updates on the top ASX uranium stocks in 2023.

Oil & Gas

The international market for gas has been upended this year with Russia’s invasion of Ukraine. Below we list THREE Small Cap stocks that have strong niches from which to exploit the rising gas prices.

Gold

Gold remains the ultimate safe haven. But what you pay for the gold miners is where you make the big returns over time.

Get Instant Access To Our Best Shares To Buy Today

Get into our research now. Start acting on our best stocks to buy research for 14 days free. No credit card required just enter your email and you're away.

Banking, Technology and Big Blue Chips

Grow with Small Caps, Protect with Blue Chips

Banking & Finance

From National Australia Bank (ASX:NAB), to the commonwealth bank of Australia (ASX:COM), Find out which banks are good value, the big news in the US and why the Australian banking sector is unique and secure!

Technology

Running off the highs from Integrated Research (ASX:IRI) returning 75% in the past 15 days, Rich dives into the high octane technology sector to find the diamonds in the rough. Value investing has never been more important.

Blue Chip

Blue Chips are the leading companies listed on the ASX. These are the giant financials, industrials and resources stocks that are the top household names.

Start investing for growth: Small Cap Stocks

We love growth stocks, or small caps for their outstanding returns.

Our analysts find companies with small market capitalizations, in niche positions, well managed and are positioned for exponential growth.

Not all stocks however, are golden, so which to choose?

We do the hard work for you. Go to our Best Stocks to Buy now.

Our goal is to help you attain financial freedom with ASX small caps.

You'll get focused, practical advice from experienced independent stock pickers and analysts who show you the best stocks to buy on the Australian stock market.

Small Caps

Our analyst team select small cap stocks that are positioned to be growth stocks, have strong earnings, experienced management and long term potential for investors.

Stock picking is about future growth

Stock picking always looks easy in hindsight, but picking the best stocks for future growth is hard to do! That's why independent research and smart stock picking are essential.

Earnings and financial strength

Our investment approach looks for earnings, financial strength and companies that operate in a niche industry that have a clear catalyst for success. These quality Australian companies operate in a broad range of industries including resources: gold, lithium, uranium, manufacturing, med-tech and more!

What is a Safe Stock to Buy?

Covid-19 showed that the stock market moves fast and you can win or lose. There is also risk by leaving money in the bank, with interest rates so low your money is losing value over time.

To reduce your risk you need to diversify. We advise building a portfolio of top ASX shares, owning 7-15 quality companies in different industries. It's all about diversification and we can help you with our expert stock tips today!

Start Growing your wealth now

We recommend you Login now for 14 days FREE and go straight to our Best Stocks to Buy today list on our subscriber dashboard.

How we find the Best Shares to Buy in 2023

Our Small Cap tips have outperformed the market for the last 10 years. Our analyst team is focused on finding QUALITY Small Caps:

Why have our subscribers done so well from our ASX Small Cap Stocks?

It's much easier for Small Cap stocks to double or triple in revenue than for larger Blue Chip stocks such as banks. A Small Cap stock that grows and performs well will draw more attention, increasing trading volume and driving up its valuation. These top ten best shares to buy demonstrate our performance and we continue to drive outstanding results and revenue for our subscribers.

Richard Hemming, Editor