Market Insight: Should you Buy Oil?

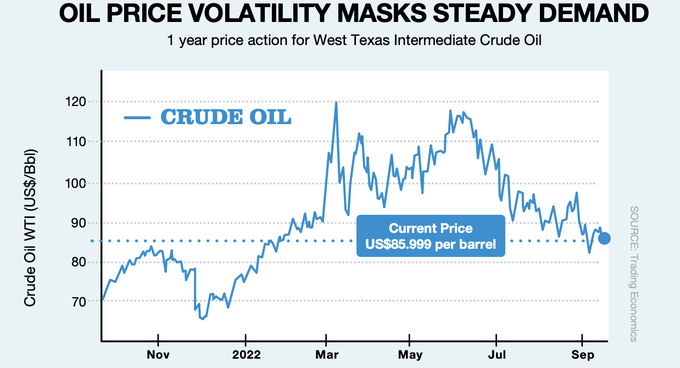

Both oil and gas provide opportunities to make money from ASX listed Small Caps. The key with oil is two-fold: global economic growth is in decline; and there continues to be a lack of supply. We continue to favour small producers because they have the flexibility to exploit the changing energy landscape.

Demand Coming off the Boil

The possibility of a recession in major markets is a threat to oil demand.

China’s demand has shrunk for the first time since 2002 due to its zero Covid policy with oil imports since the start of the year down for the first time since 2004.

The demand trough has coincided with interest rate increases in the US and Europe, connected with dampening inflation. This has lowered demand around the world. US based logistics company FedEx’s first quarter result missed revenue and earnings. The company reported weakening global shipment volumes in every segment around the world.

EU Sanctions Provide Hope for Oil

EU Sanctions Provide Hope for Oil

A partial embargo on Russian oil from December is providing support for the oil price. The sanctions remove 1.3 million barrels/day, on top of petroleum product imports worth another 1 million barrels/day. This might represent as much as 2%, but marginal activity can make a big difference when supply is running so tight.

Of course, China is the big support for Russian oil and inevitably some of this product will find its way to Europe. For how much longer China carries Russia is the big question.

Supply Constraints Support Oil Price

While recent higher oil prices and risks to supply have provided a fillip for small to mid-size oil companies, longer term investment in new capacity and oil exploration will be constrained by the availability of finance and community concerns.

The diminished expected future for oil will impact investment horizons and the assumed life of projects, reducing the pool of oil projects likely to be developed. The fall in new projects and the natural decline rates of projects will inhibit oil production, leading to potential higher prices. Higher oil prices will in turn incentivise oil substitutes.

There are a few small companies on the ASX we recommend, which provide healthy exposure to the oil price.