Small Caps are the TOP performing FAST GROWTH Small Companies BEFORE they are household names.

We look for stocks that produce double-digit plus return on equity. The compounding effect of that on a small asset base is much greater than for a bigger one. With the right small cap, with the right management and the right project, you can make exponential returns.

It’s no accident that we have produced an average return of 66.2% over more than 300 different buy recommendations over 11 years. Just look at our returns on #PLS, #PDN, #NST, #AKE and #KAR.

Richard Hemming, Founder Editor, Under the Radar Report

EOFY: Save $150 on our Reports

Save $150 on Small Caps + Blue Chip Reports

Offer Closes: 30 June!

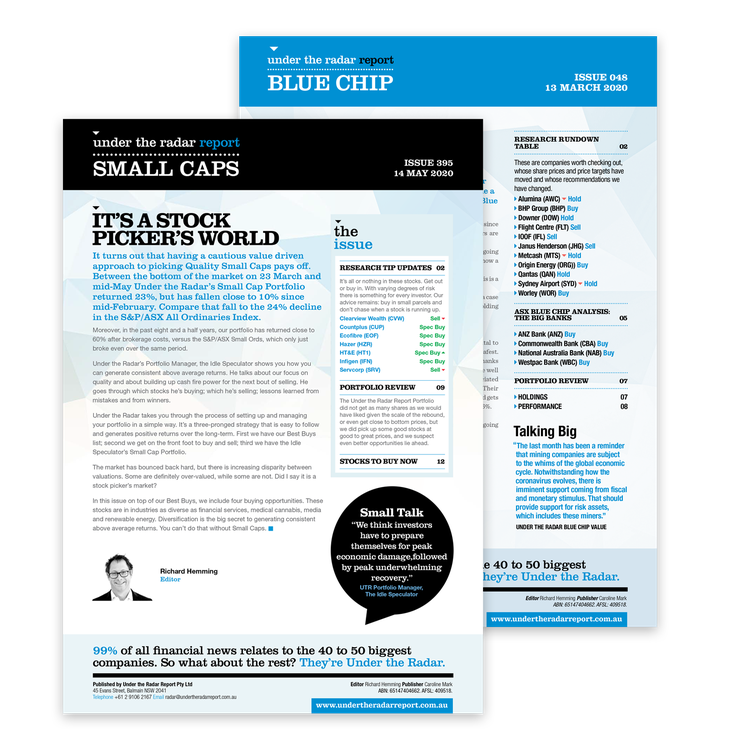

Read #1 Small Cap stock research before you invest your money.

These are the stocks with high growth potential BEFORE they are household names.

It's much easier for an ASX small company to achieve fast growth and double or triple in size than for the big ASX large cap stocks to grow by 5 or 10%.

AS A SMALL COMPANY GROWS, SO DO YOUR RETURNS.

Find out about the Small Cap stocks on the rise now.

Did you know that small cap stocks were among the top stocks of the last century? Amazon's shares were worth about $17 in 1998 and Tesla's shares were worth just over $1 billion in 2010. However, at the time it seems unlikely that small businesses would or could become giants.

Investing in a small company is rewarding, but the risks, are something investors must consider. We've taken a close look at the stocks we've selected.

Should I Invest in Small Caps?

Investing in small cap stocks increases your portfolio's profitability. Small caps generally form the foundation of every profitable ASX share portfolio. It is conceivable these companies will offer high growth opportunities. Some of the largest shares by market cap have been replaced by smaller cap stocks. Think Amazon and Tesla that weren't even around a few decades ago. There are lots of unique Australian examples too

Are Small Caps A Good Investment

Small Caps are a part of every good investment portfolio. Our mantra is Small Caps for growth, Blue Chips for protection. Not every stock will outperform, so successful investors look to diversify with 7-15 stocks. Small Caps can transform your future performance and give you exposure to a wide range of industries cheaply. You only need one or two to double, triple or more to really impact your returns.

ASX Small Caps Give you Growth & Dividend

Individuals invest in ASX Small Caps for growth but also for dividends. Over 50% of the ASX Small Caps that Under the Radar Report recommends pay out earnings. We give you quality research on ASX Small Caps you won't find anywhere else.

Invest in powerful ASX Small Caps with Australia's #1 independent stock report

Out-performing the benchmark since 2011. Start your free trial and access Small Caps to purchase.

Why does it matter to you?

Our results means that shares had to double, triple and more in value and the company's shares had to rise by many multiples to bank these big gains. That's exactly what happens. Look at our lithium stocks like Pilbara Minerals (PLS) which is a great example.

When a stock is taken over it is is common for the share price to rocket. Think AVA Risk (AVA), Tassel (TGR), Big Air, Afterpay ... it's a long list at Under the Radar Report.

1 in 5 of our stocks are taken over bringing money making power to our subscribers.

These are stocks that investors hadn't covered or invested in but have made big returns for our subscribers.

The Small Caps on the ASX are just too small for the big fund managers to put their funds into

Fund managers don't purchase companies until they've reached $100 million but they'll be more cautious about investing in any stock under $500 million. You as an investor are better equipped than most of the professionals as you can buy smaller companies with a lower market capitalisation while they are still cheap! The fund managers must wait until it's grown to a bigger size before they can buy in. The point that they do, also drives the share price higher. It's at this small end of the market, not the large caps, where individuals have the advantage.

You simply can't realise the kinds of gains in other investments, including large cap companies that you can in smaller companies.

Start your free trial and access Small Caps to BUY NOW.

Since 2011 we have been delivering quality independent ASX Small Cap stock advice. Click through to view our best-performing Small Caps.

Why do you need ASX Small Cap research?

In contrast, what you see with ASX Small Caps, is “information risk”. The companies are too small for the big brokers to invest in so there is not the research around. Also, with these ASX Small Caps, the company's historic earnings performance can often bear little resemblance to their future earnings and so you need quality research before you invest in them.

We do all the research so you don't have to

At Under the Radar Report, we provide you with independent, institutional grade Small Caps research, and show you exactly how to structure a portfolio. We help you choose Small Caps for your portfolio and we are delivering strong returns for our subscribers.

We recommend structuring your ASX share portfolio clearly and that up to 25% of your portfolio should be invested across 7-10 ASX Small Caps to diversify your portfolio across a wide range of sectors including resources, mining and financials and position it for growth. Our weekly Small Cap stock report provides you with ongoing updates advising you when to Buy, Hold and Sell.

Why Invest in Small Caps

ASX Small Caps offer investors share price growth. Under the Radar Report's annualised average return on all our 100+ ASX Small Caps is over 50% and this includes some real duds, but it also includes companies like Sirtex Medical or Select Harvests that were small companies when we first tipped them but then tripled in value and more. Plus over 50% of the ASX Small Caps we recommend pay dividends. At Under the Radar Report, we look for value, which means a ASX Small Cap that is covering its costs but has an option on greatness. You can’t find these types of investments anywhere else.

Case Study: What ASX Small Caps can do for your Portfolio

Our editors family invested $70,000 into a ASX Small Cap silver and gold miner Bolnisi Gold with operations in Mexico. They invested at 9 cents and below between December 1996 and October 2003. Less than four years later the ASX Small Cap company merged with Coeur d’Alene Mines and is now the world’s largest listed primary silver producer. Its stock rose to $3.27 by June 2007, making their family $1.5m.

ASX Small Caps really can grow a portfolio as seen here with Bolnisi Gold. ASX Small Cap companies can be at the risky end of the investment spectrum which is why you need to undertake thorough analysis of their sustainable earnings and balance sheets. This is where Under the Radar Report comes in.

Invest Successfully with our Stock Reports

Start owning small cap stocks and get quick access to the cheapest and best small cap investment advice in Australia with our free trial.

Look at our past performance and how we have made money on small cap shares.