Lithium Market Size, Industry outlook and growth

Lithium Market Growth Industry

The lithium bears like Goldman Sachs are well and truly in their box! The bottom line is that direct lithium extraction is very complex, and there are many hurdles, which have been magnified by supply chain difficulties.

The latter means that new projects are going to be thin on the ground and existing producers or those that are close to production will be big beneficiaries of a higher for longer lithium price in the global lithium market.

Over the weeks we will be diving into the lithium market and the lithium industry to bring you our lithium favourites.

We identify and research quality ASX Small Cap stocks to buy now. Access our Small Cap report for just $59 a month!

Are you ready to invest in Lithium Stocks now?

Get access to our best stocks to buy now. 14 days free. No credit card required just enter your email and you're away.

LITHIUM BEARS ON THE RUN

For all the controversy over sceptics, most famously Goldman Sachs, which earlier this year claimed the bull run in the lithium market was over, the lithium prices action seen in the graphics above highlights the very opposite.

Moreover, the lithium stocks we like generate big free cash flow even at prices well below current levels.

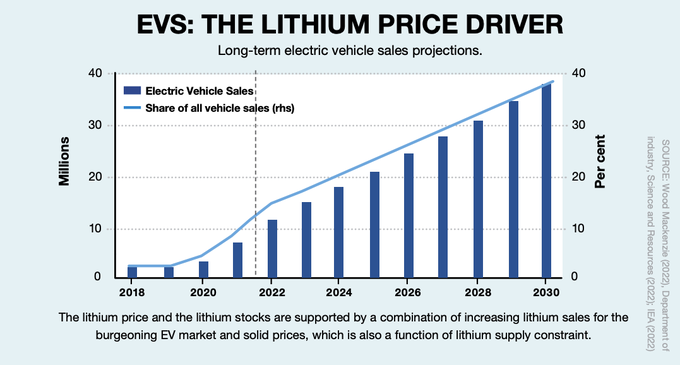

The big driver for revenue growth is that the projected lithium supply, based on known and likely mining projects, is well below the lithium demand inferred from the production schedules of gigafactories and electric vehicle makers in the automotive sector.

Further, lead times for lithium mine and brine projects have lengthened and there is the likelihood of construction and commissioning delays. There is now the probability of supply shortages to 2030 and beyond in the face of increasing demand in the global market.

To read more about Lithium, please click here.

RIO TINTO LEADING THE BATTERY POWERED CHARGE

Weighing into the debate mining giant Rio Tinto (RIO), whose head of Mineral resources, Sinead Kaufman, said late last month that the lithium market would fall 50% short of the lithium required by 2030 to keep pace with demand of the EV market and other key companies, even if every planned mine is developed. Rio Tinto is one of the major players trying to meet the soaring demand for lithium.

Kaufman said RIO is dedicated to building a portfolio of assets, including lithium, that are critical minerals to rechargeable batteries or the li ion batteries used in digital cameras, the ev industry, mobile phones.

The mining giant has already demonstrated this intent, with acquisitions this year in Argentina (Rincon) in South America and Jadar in Serbia, although government approval for the latter has been refused. RIO has also recently exercised an option to earn an 80% interest in the North Rover lithium pegmatite target in WA, in joint venture with Twenty Seven Co (ASX:TSC).

Chart 2: Battery Power

PRODUCTION NEEDS TO MEET TRANSPORT SECTOR TIME FRAMES ESPECIALLY FOR ELECTRIC VEHICLES

Volatility in 2022 battery metals prices could be a warning sign of the challenges to come in meeting accelerating EV demand projections, and in the battery supply chain itself. According the industry consultant Benchmark Mineral Intelligence, battery demand growth is forecast to be “double-digit” for the foreseeable future indicating the growth in the global lithium market size too. Battery manufacturers especially in consumer electronics need a steady growth or a new supply of raw materials to keep up.

Estimated 2022 growth is 14% on 2021's battery production of 450 gigawatt hours (GWh). In the early 2030s, this is expected to top 3,000GWh in the forecast period.

For a lithium market balance, increasing lithium production is needed to meet rising demand led by ambitious timeframes to electrify the transport sector, with electric vehicles makers making multi-billion dollar investments to shift from internal combustion engine lines to EV production lines, in line with community expectations and government policies. This push by the EV sales will redefine the global lithium market report. If government subsidies are ramped up, more lithium resources will be needed.

Ultimately, global lithium availability is one of the major limiting factors impacting what the actual demand number ends up being.

If you are interested in learning more about the mining sector and how to invest in this area, read more here.

HIGH SPOT PRICES LEADING TO RISING CONTRACT PRICES

Most lithium producers in Australia have historically utilised long-term contracts. High average prices now being reported by Australian producers indicate higher spot prices are now flowing more rapidly into contract prices.

Shortages of spodumene concentrate, from hard rock mining, lithium hydroxide and lithium carbonate, have continued to push spot prices to new records.

The spot prices are likely to moderate, but the key is that average prices are supported by continuing lithium demand, combined with the lack of supply. A driver of the high spot price is the push by refiners and battery makers in the battery supply chain to build up inventories due to concerns about global supply chains. If these concerns ease, spot prices could fall.

Indeed, spodumene prices are expected to average US$2,730 per tonne in 2022, more than 4.5 times where their average in the prior year of $598*. The driver is the current record spot prices feeding through into contract prices.

Spot spodumene concentrate prices were US$4,720 per tonne (SC grade 6.0%, CIF China) in August 2022. Average prices are expected to rise to US$3,280 per tonne in 2023 before moderating to US$2,490 per tonne in 2024*.

Access our favourite Lithium stocks today.

Subscribe to our Small Cap report for just $59 a month!

*According to the Australian government publication Resources and Energy Quarterly September 2022

:quality(75))